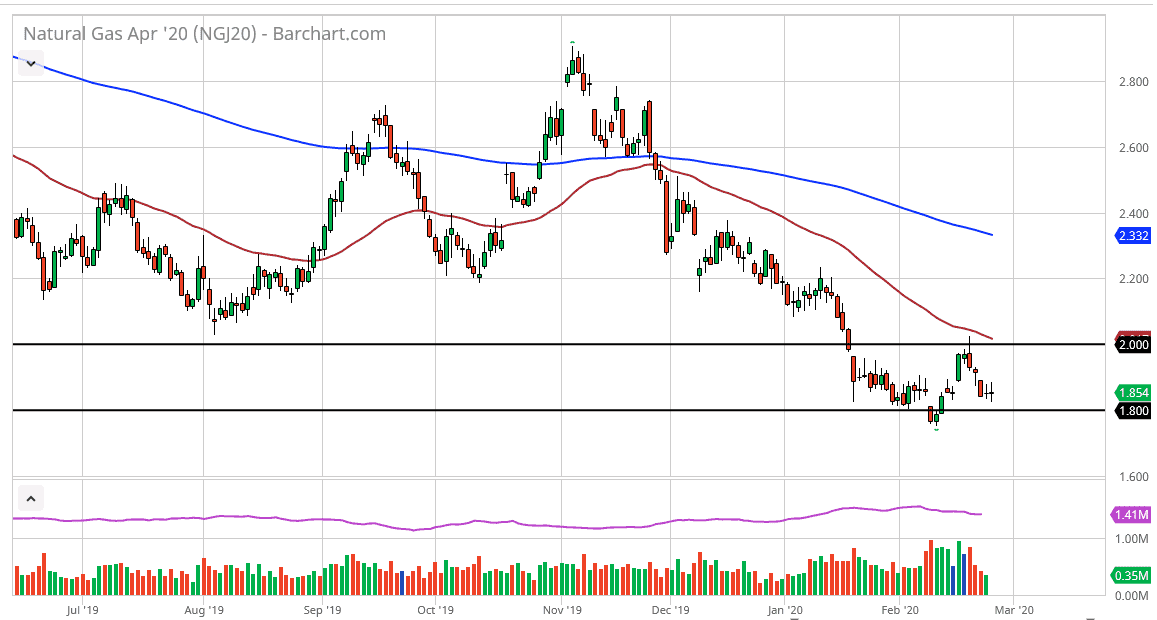

Natural gas markets did very little during the trading session on Wednesday as we sit just above the $1.80 level. This is an area that has been supported for some time, so it makes sense that we continue to see a bit of stability here. The market should continue to see a lot of general noise in this area, and the candlestick for the end of the day suggests that we are simply waiting to see what the next inventory figures are.

The market also sees a lot of resistance at the $2.00 level above, and the 50 day EMA is starting to reach towards that level as well. Those are a couple of different reasons to think that sellers will come back in and push this market lower. Signs of exhaustion near that area will be jumped on by longer-term traders, as short-term traders will continue to push this market back and forth. That being said, the market can break above the 50 day EMA, then it’s likely that the market goes looking towards the $2.20 level next. That is an area that should see plenty of selling pressure, so I think that if we do rally to that area, it’s likely that the market will punish natural gas at that point. After all, we are extraordinarily oversupplied, and it makes sense that the price continue to keep lower levels in mind.

If the market was to break down to a fresh, new low, then the market will more than likely go down to the $1.60 level underneath and test what has been a longer-term support level. In the meantime, though, I suspect that we are probably going to trade in a $0.20 range between the $1.80 level and the $2.00 level. Expect a lot of volatility in this area, as traders are trying to express what the markets are going to do, but at the same time we are at extraordinarily low levels so it’s very difficult to get short at this point. Waiting for rallies to show signs of weakness is probably the best way to go going forward, at least until we get those bankruptcies in America that are so desperately needed. There are far too many suppliers and drillers out there to expect that supply is going to suddenly dwindle away, especially considering that we are heading towards the warmer time of year.