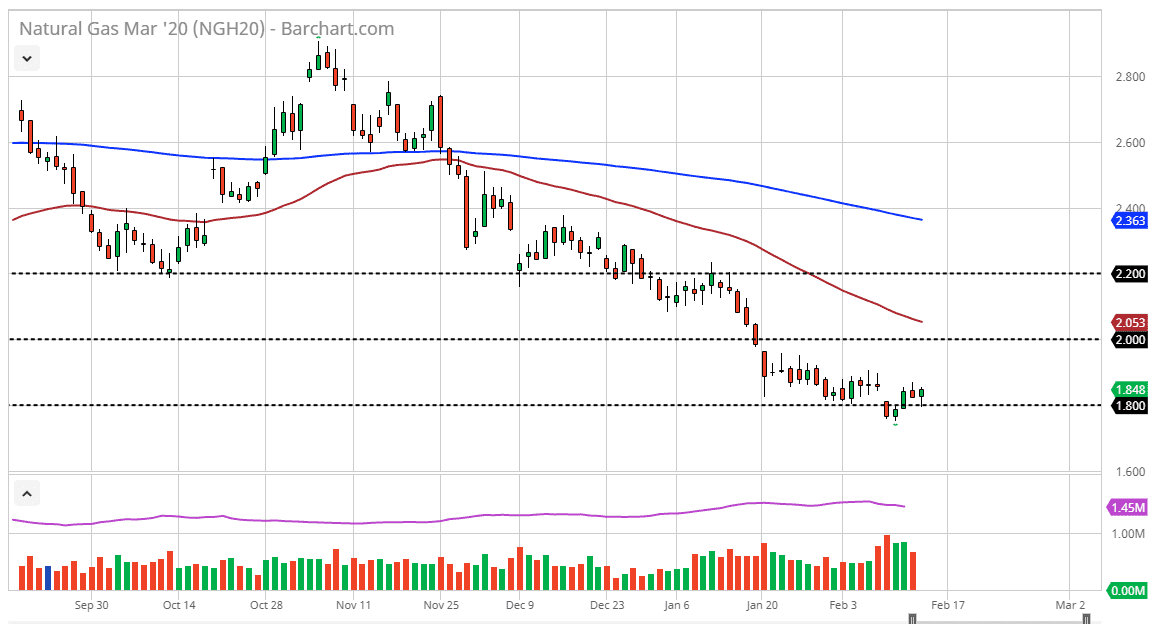

Natural gas markets have initially fallen during the trading session on Friday but have also found plenty of support at the $1.80 level underneath. By bouncing the way, it has, we ended up forming a relatively bullish looking candlestick. With that in mind I like the idea of waiting on any potential bounce to take advantage of later. Don’t get me wrong, I’m not a buyer and recognize that even if you were to promise me that this market was to open higher on Monday, I still would be waiting for a sell signal. This is a market that has a huge amount of negativity attached to it and rightfully so.

Temperatures have dropped a bit during the last couple of days and that could add some bullish pressure to natural gas in the United States but I think this is a transitory effect more than anything else. After all, the natural gas markets are extraordinarily sensitive to weather, but there is a substantial in structural oversupply of natural gas and therefore massive amounts of downward pressure.

We have come back to fill the gap from the beginning of the week, and that of course is a somewhat strong sign, and if we can break above that gap, I think that’s even more bullish. However, there are several areas above that could offer selling opportunities and therefore I’m going to pay close attention to them. For example, I believe that the $1.90 level is an area that offers quite a bit of supply as we have seen in the past and should in the future. Furthermore, the $2.00 level will offer a lot of supply due to the fact that it is psychologically important, and of course the 50 day EMA is sitting just above. The trend has been to the downside for quite some time, and I think that continues to be the case. We will eventually get a host of bankruptcies that will help dwindle some of the supply, but we are a long way from there. If that does happen though, we may finally get a trend change. I don’t see that happening anytime soon so I simply look for signs of exhaustion to jump on as most traders will probably be doing the same. Alternately, if we break down below the lows, then it’s possible we go down to the $1.60 level underneath which has been important in the past.