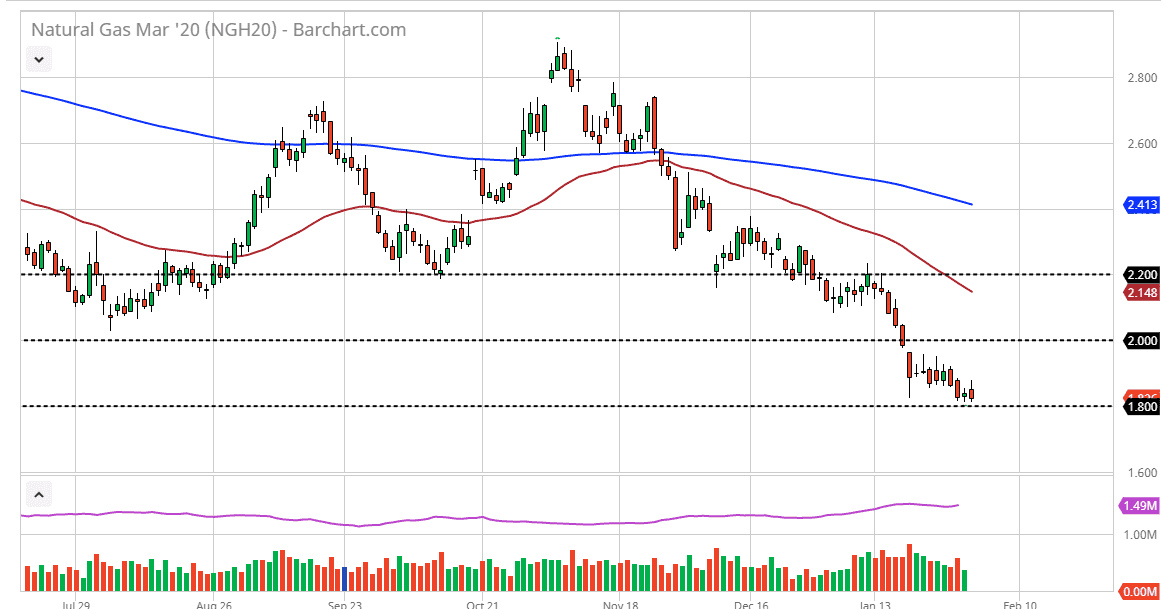

Natural gas markets have been a complete disaster this winter, and with temperatures in the United States still very mild it’s difficult to imagine a scenario where suddenly the market will spike for anything more than a short-term play. Quite frankly, the winter has been far too warm in the United States for supply to get chewed through, and therefore it makes sense that we should continue to see a significant issue when it comes to trying to pick up prices. Ultimately, this is a market that seems to move in $0.20 increments, with the most obvious one right now being the $1.80 level underneath offering support. To the upside, the $2.00 level would be resistance, and it should be pointed out that on longer-term charts the $1.60 level was a massive support level from which the market rallied for years from.

That being said, the fundamentals in the natural gas market are much different than they were back then, as fracking has made the supply of natural gas far too overwhelming to see significant gains possible. In fact, 2020 might be a bit of an inverse year in the sense that it comes down to when the bankruptcies come. There are hundreds of companies presently under threat of being bankrupt in the United States due to the fact that the oversupply has killed pricing power. This could be the saving grace for natural gas, the natural destruction of an oversupplied market. Unfortunately for producers, the commodity itself isn’t necessarily hard to come by, so at this point most natural gas producers are on the ropes. Credit agencies in the United States have been downgrading the credit worthiness of most of these corporations, and then of course will cause quite a bit of financial stress in these companies. If that does in fact come to fruition the way it looks like it’s going to, we should then start to see less production. It’s possible that we may see natural gas rally in the summertime, or possibly even the fall if the bankruptcies come quick enough. That being said, it’s probably more or less going to be a story for 2021 and as things stand right now.

In the short term, the only thing you can do is fade rallies as they occur or sell a breakdown below the $1.80 level to reach towards the $1.60 level on the bottom. It’s still easier to fade rallies though, because it gives you a little bit of real estate to work with.