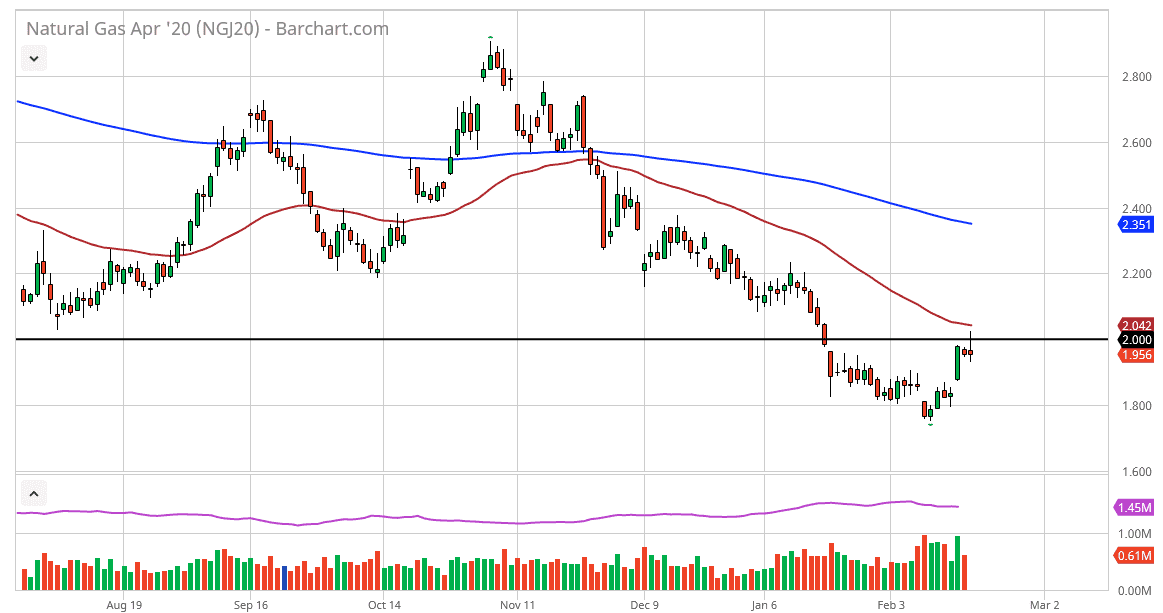

Natural gas markets shot higher during the trading session on Thursday, reaching towards the 50 day EMA but has pulled back to show signs of exhaustion. In fact, the daily candlestick forming a shooting star right at the $2.00 level is in fact a very negative sign. Ultimately, this is a market that looks as if it is ready to rollover, as it is in an extraordinarily negative candlestick. The market breaking down below the bottom of the candlestick could go looking towards the gap underneath, which kicked off the week. That means that the market could go looking towards the $1.83 level, and it would not be a huge surprise to see the market drop off heading into the weekend as holding onto natural gas contracts to the upside will certainly be a very difficult thing to do.

On the other hand, if the market was to break above the top of the shooting star and more importantly the 50 day EMA above, the market could go reaching towards the $2.20 level. That’s an area where there has been massive resistance, so at this point it’s likely to just rollover. I’d be a seller either here, or the $2.20 level. The market has been in the long term downtrend, and as a result it’s very likely that we continue to go lower. The market has been oversupplied for natural gas for ages, and it is a structural problem going forward.

Until the oversupply gets fixed, it’s very unlikely that anything substantial can happen to the upside in this market. This is a market that is at extreme lows, and therefore this bounce makes quite a bit of sense. Even if we break down below the lows, the market probably will go looking towards the $1.60 level underneath as it was an extreme low previously. Given enough time, we will have enough of bankruptcies in the industry to drive down the supply, but until that happens natural gas will continue to struggle. This is only going to get worse as temperatures warm up in the United States. With that, I remain negative, but I realize that this is a shorter-term trading market, and therefore you can’t be looking for huge moves right now. A breakdown below the day for me signals that we are probably getting ready to fill the gap as futures markets are notorious for doing so.