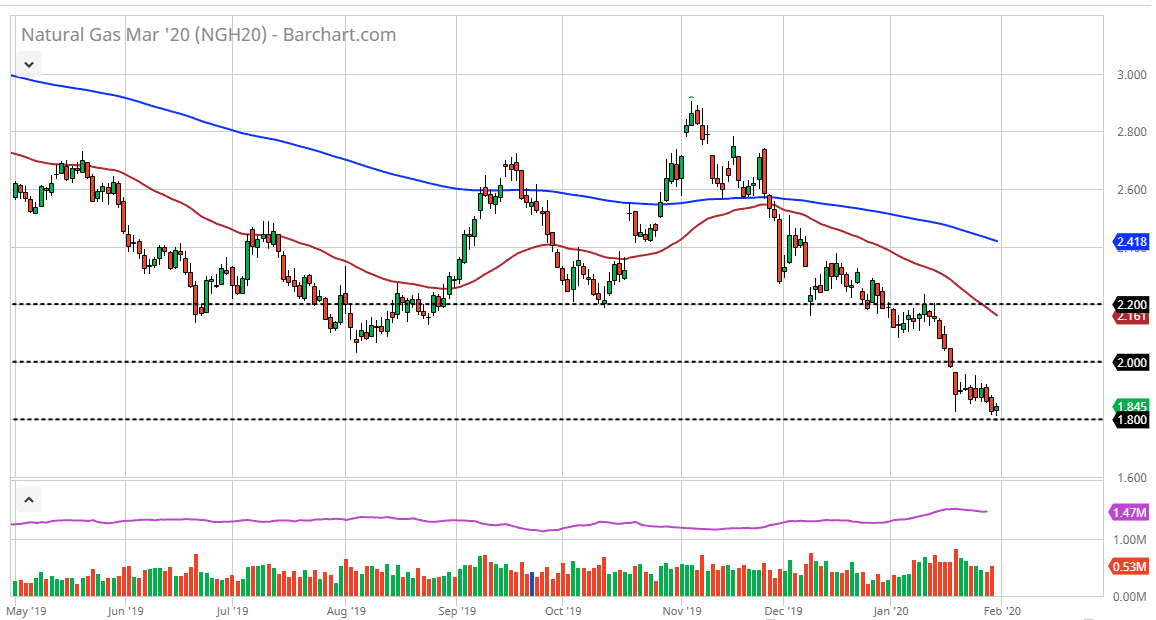

Natural gas markets have fallen a bit during the trading session on Friday, to reach down towards the $1.80 level. This is an area that has offered support a couple of times, and also has been important historically. Nonetheless, the market breaking down below the $1.80 level will probably have the market looking towards $1.60 level underneath as it is a multi-year low going back to 2015. In the meantime, natural gas will continue to suffer at the hands of oversupply, as natural gas simply cannot pick itself up off of the floor.

Looking at this market, it’s possible that we could go looking towards the $2.00 level, an area where I would expect to see selling as well. The oversupply in natural gas of course is exacerbated by the fact that the Americans have drilled 17% more this past year than it did previously. Ultimately, if the market continues to see this oversupply, there’s no way that it can continue to go higher on any type of short-term bounce. I like the idea of fading rallies as they show signs of exhaustion. If we do break down below the $1.80 level, then it’s likely that we could go looking towards the $1.60 level rather quickly, because it would be yet another “trapdoor” opening.

All things being equal, I also believe that the red 50 day EMA is going to offer plenty of resistance, and any move towards that level will be a welcome selling opportunity. We could get that move, as we roll into February there could be more demand on natural gas but quite frankly, we are far too late in the wintertime to think that any significant rally can sustain itself. In fact, the futures market is currently trading the March contract, which obviously will be even less demand than we see currently. Nonetheless, these occasional spikes to happen but look at that as an opportunity to step in the market and punish natural gas yet again.

Natural gas will rally eventually, and it will stick. However, the biggest driver of higher prices will more than likely be several drillers and natural gas related companies in the United States going bankrupt, something that you should see this year as far too many of them are in serious financial trouble due to the lack of pricing power in this market. At this point, the natural gas boom is about to become a bust as far as drilling is concerned, but that is something that will take months to play out.