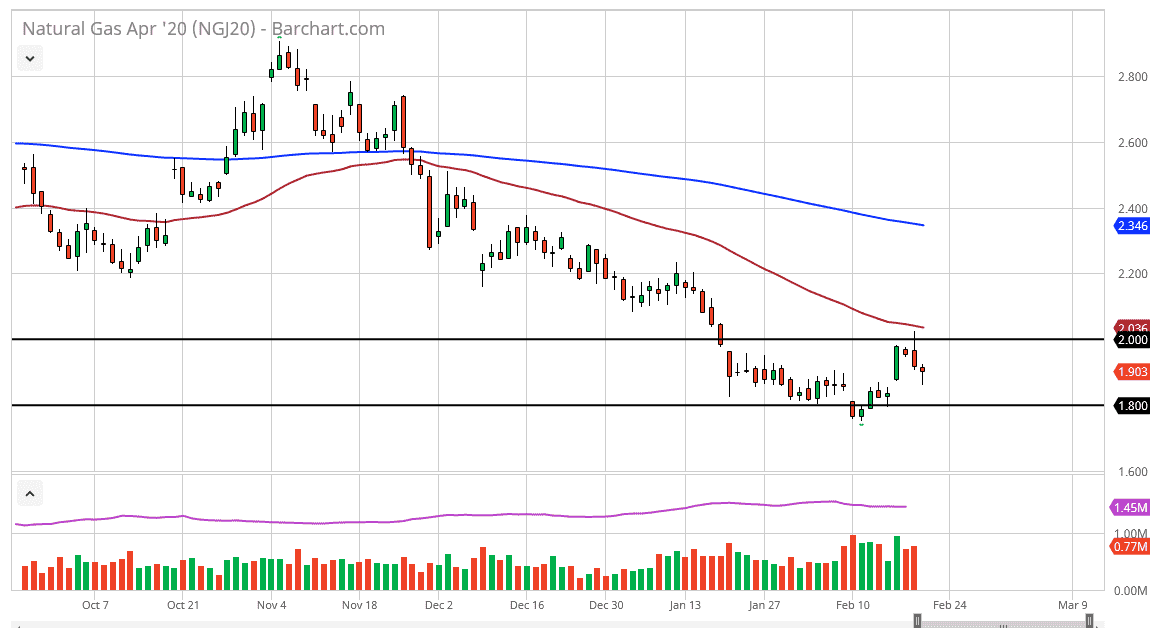

Natural gas markets initially fell during the trading session on Friday, reaching down towards the gap that had formed at the beginning of the week. The market finding support in that area isn’t a huge surprise, as it’s quite common. At this point, it’s very difficult to imagine a scenario where we would be able to hang on to this market for a longer-term upward movement, but the fact that the Friday session gained back the way it did suggests to me that there is some resiliency.

The 50 day EMA above should continue to offer resistance, as this is just above the $2.00 level. Any rally at this point should run into a lot of noise, so look for signs of exhaustion in order to start shorting again. If we do break above the 50 day EMA, then the market could go higher, perhaps reaching towards the two point to zero dollars level. Ultimately, that level will have even more resistance built in based upon the recent action. Ultimately, the market should see plenty of volatility in choppiness, as the selling pressure continues to be drastic, but we are at extreme lows.

By forming the couple of candlesticks, we have during this week, it tells me that we are very likely to continue going back and forth but obviously there’s much more downward pressure than up from a longer-term standpoint. The oversupply of natural gas continues to be a major driver of where this price goes, and as a result I prefer to fade rallies as they occur, but I also recognize that the 1.80 level underneath will be massive support. If we were to break down below there, then it could open up the door to the $1.60 level underneath. Ultimately, this is a market that continues to be very focused on the fact that the oversupply of natural gas is a major issue, but in the short term it looks as if the colder temperatures in the United States will push this market to the upside. That’s a short-term effect though, and it’s not until we get longer-term bankruptcies that I think that this market can rally for any significant move. Overall, back and forth noise should continue to be a major issue when it comes to trading the natural gas markets, but clearly you should be looking for an opportunity to fade rallies when they occur.