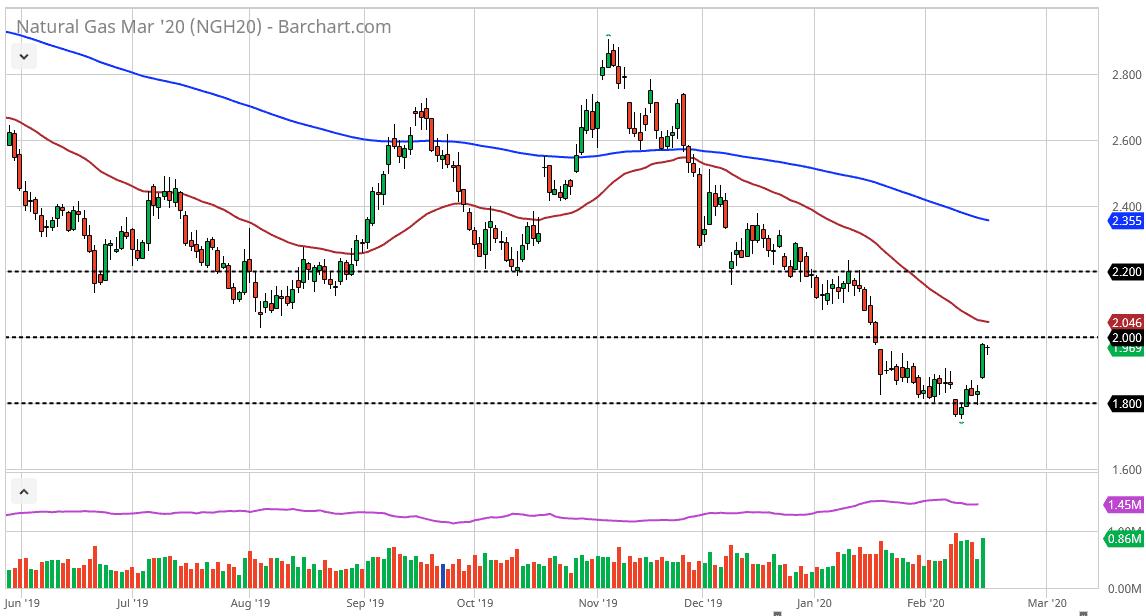

Natural gas markets did almost nothing during the trading session on Wednesday, as we had exploded to the upside on Tuesday. The market needed to digest the gains, and quite frankly we are sitting underneath a large, round, psychologically significant figure. The $2.00 level is an area that will attract a lot of attention, and then beyond that there is a major 50 day EMA sitting just above the $2.04 level. Ultimately, the market looks likely to run into a bit of trouble here, but I think at this point it is simply waiting to see what the inventory figures tell us.

The weather reports for the next couple weeks will be followed closely in the United States, and it does look like we are going to see a drop in temperatures. Nonetheless, that is going to be a short-term opportunity, as the market is very likely to see plenty of selling opportunities over the longer term due to the fact that the natural gas markets are so oversupplied, not only in North America but around the world quite frankly. The Americans and the Canadians continue to push out tons of shale gas, but we have also seen explosions in the growth of the gas production of places like Egypt and Mozambique. In other words, one thing that the world is not going to be short of is natural gas.

Ultimately, I believe that the two dollars region should show plenty of selling, but even if we break above there, I think that the $2.20 level is also going to be massively resistive. Signs of exhaustion are what I’m looking for a daily close as a signal to start selling again. In the meantime, I will simply let the market continue to rise because it makes for a better trade. I have no interest in trying to go long of natural gas, and quite frankly I don’t know when that situation would change in the favor of buyers. Simply waiting for an opportunity to sell again is the best thing you can do. This is a lot like gold markets in the 1980s, no matter how hard they fell, it seemed like there was always further to go. Granted, there are going to be the occasional rally here and there, but given enough time sellers will come back in due to the fundamental oversupply of this commodity worldwide.