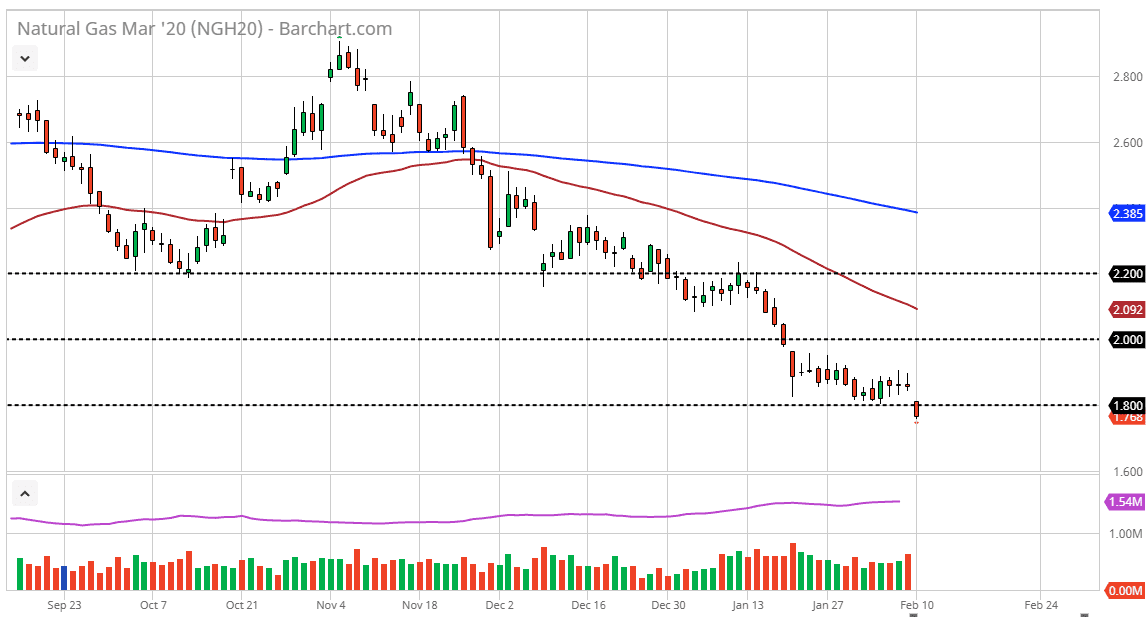

Natural gas markets plunged again, as the market started off with a bang to the downside. Whether reports for warmer temperatures in the second half of February in the United States continue to drive down demand even further.

Natural Gas

Natural gas markets simply can’t get out of their own way at this point, gapping lower at the open on Monday to break down below the $1.80 level. This is an area that had been supportive in the past, but now has been broken finally. At this point, it’s very likely that the market will go looking towards the next major support level in the form of the $1.60 level over the next couple of weeks. Unfortunately for natural gas suppliers, we have just had the second warmest January in the last 70 years in the United States, which of course has crushed demand for natural gas in what was already in oversupplied market. The fact that the next couple of weeks are going to be warm as well certainly can’t be very encouraging.

At this point, the only thing that’s going to save natural gas markets is going to be the impending bankruptcies that are definitely coming. Quite frankly, I now people need to go out of business in order to drive down the supply from drillers to have no other choice but to keep on working to pay bills. All things being equal, I believe that any rally at this point will see significant selling somewhere in the gap, so therefore you can’t get bullish or even get cute to try to fill the gap. Signs of exhaustion after short-term rallies should continue to offer decent short side trades, but at this point it’s obvious that this market is going to struggle to pick up any upward momentum anytime soon.

Even if we did break out to the upside, I would simply be looking to sell this market again on signs of exhaustion. That has worked for months, and quite frankly winter never came to the US so that has a certain amount of oversupply built into it as well. 2020 should continue to be miserable for this market, but eventually enough people go broke that they leave the game. Until that happens, I can’t make an argument for buying this commodity even though we are at extraordinarily low prices.