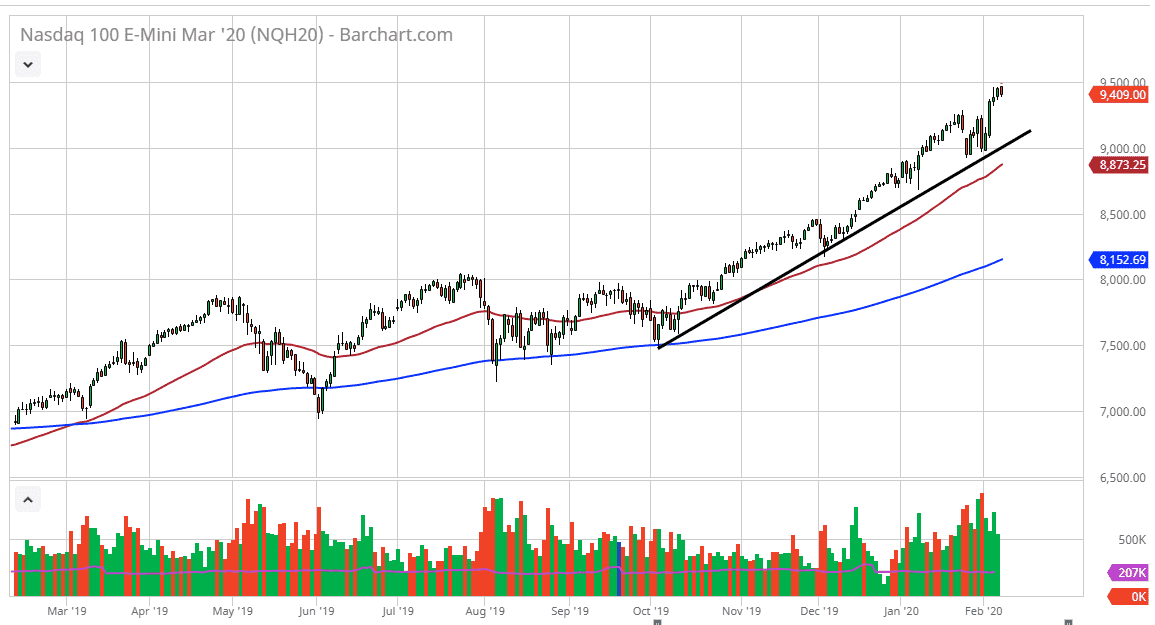

The NASDAQ 100 has pulled back a bit during the trading session on Friday as the stock market in general did in the United States after a reasonably decent jobs number. That being said, the most important thing to pay attention to is that the NASDAQ 100 has reached towards the 9500 level, and therefore had to pullback due to the psychological resistance built into that level. I do think that a pullback is coming, but I don’t necessarily think that it’s a huge pullback. After all, there is a nice uptrend line underneath, and it should continue to bring the market right along with the trend as it has recently. Furthermore, the $9000 level and the 50 day EMA underneath should continue to see buyers.

That being said, if the market does break above the 9500 level, then it’s likely that the market goes looking towards the 9750 level, and then eventually 10,000 after that. Ultimately, that’s a longer-term target and with earnings season starting to flip over to tech companies this week, it’s very likely that we will see the NASDAQ 100 get very noisy. Nonetheless, the longer-term target will get reached eventually and I think at this point every time the market dips people will be looking at it as an offer of value.

At that juncture, I believe that the moves in the NASDAQ 100 would be very volatile and strong, as it has led the way going forward. The NASDAQ 100 has been much more bullish than the S&P 500 or even the Dow Jones Industrial Average. Ultimately, I do like the NASDAQ 100, but you have to be very cautious about your position size as it does tend to move so much quicker. In that sense, you can look at the S&P 500 as being very similar to gold, while the NASDAQ 100 might be more along the lines of silver. Sure, they both tend to move in the same direction over the longer term, but the NASDAQ 100/silver markets move very quickly.

If we do break down below the 50 day EMA, and I don’t think this happens, it does open up the door for a move down to 8500. At that point, the 200 day EMA would probably come into play, offering plenty of support. That is very unlikely to happen, but it is something that needs to be in the back of your mind.