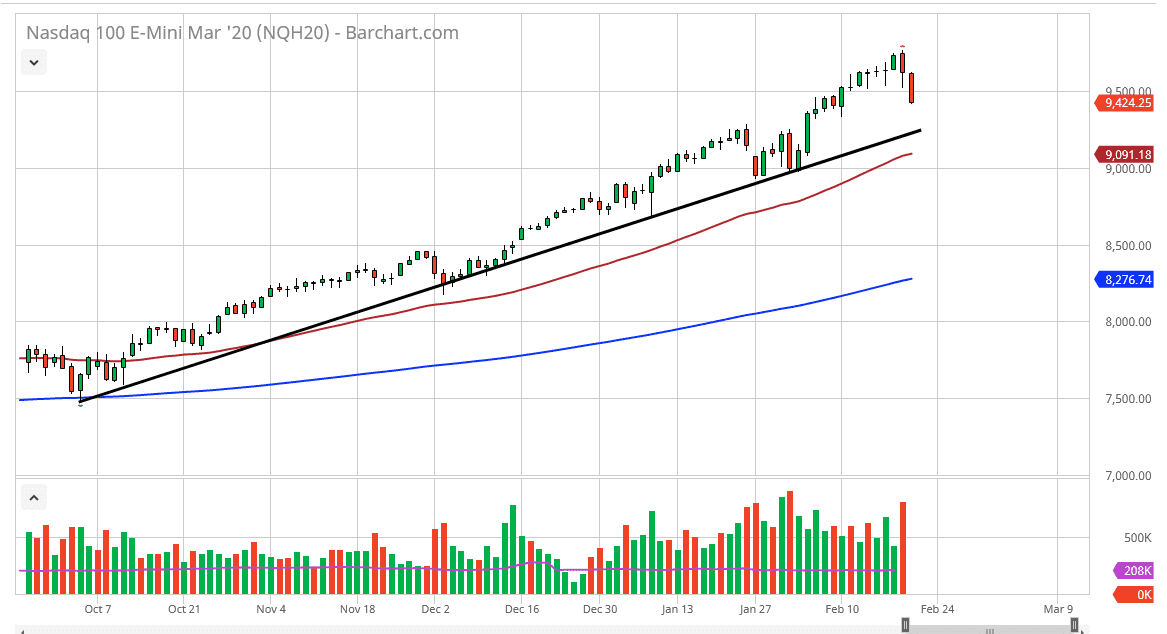

The natural order of things is that eventually what goes up must come down. The NASDAQ 100 is finally starting to see the effects of gravity, as the Friday session ended up very weak. The market is closing towards the very bottom of the candlestick, and that of course is not a good sign. The uptrend line underneath should offer plenty of support though, so I do think that it’s only a matter of time before the value hunters come back into pick up the NASDAQ 100. However, the biggest driver at this point is an even in the United States, it’s in China and the coronavirus which seems to be a never-ending story. Keep in mind that the NASDAQ 100 is full of companies that do business in both the United States and China, so obviously that has an effect on the NASDAQ 100.

Recently, the United States has enjoyed the fact that people put money towards it as it is one of the few growing economies in the G 20 right now. Granted, it’s a bit counterintuitive to think of stocks as a safety assets but if you are based in someplace like China or Thailand, it is much safer than keeping your money home under these conditions.

Looking at this candlestick and the fact that we sliced through the 9500 level tells me that there is more momentum to the downside. The uptrend line should be massively supportive, especially considering that the 50 day EMA is starting to reach towards that level as well, and therefore it is only a matter of time before the buyers come in and try to pick up value in what has been a very strong uptrend line. Looking at this chart, you can see that the market has continued to attract attention every time it dips, and I don’t think it’s going to be any different in the short term. Don’t get me wrong, I do think that we could continue to go lower on Monday, but I will be paying special attention to this uptrend line in order to get involved in this market. I have no interest in shorting, at least not at the moment but I recognize that if we break down below the 9000 handle, the market probably goes looking towards the 200 day EMA. Even then, I don’t know that I would be a major seller, just a bit more cautious.