The NASDAQ 100 has rallied again during the trading session on Wednesday, as the US stock markets are starting to defy gravity again. That being said, it makes quite a bit of sense considering that the rest of the world is struggling. The central banks around the world continue to offer a lot of liquidity, and that’s probably what most of this is about if everybody is honest. At this point, it looks like 10,000 is certainly in the cards. When you look at the markets a little closer, some of the concerns underneath the indices suggests that there are handful of companies driving the market higher, including the likes of Apple, Microsoft, Facebook, and the like. Ultimately, this is a market that continues to offer buying opportunities every time it dips, and ultimately this is a market that has seen only 17 of the stocks in this index lose money over the last 12 months.

Obviously, this is a market that’s almost impossible to short, at least in the meantime. You have to think of it in terms of everything that’s going on, and the fact that the index simply cannot fall. As long as the Federal Reserve continues to have the back of traders, it makes sense that buyers will continue to push this market to the upside every time it dips. I like the idea of buying dips and not buying up here, because this is a market that is a bit overbought in the short term.

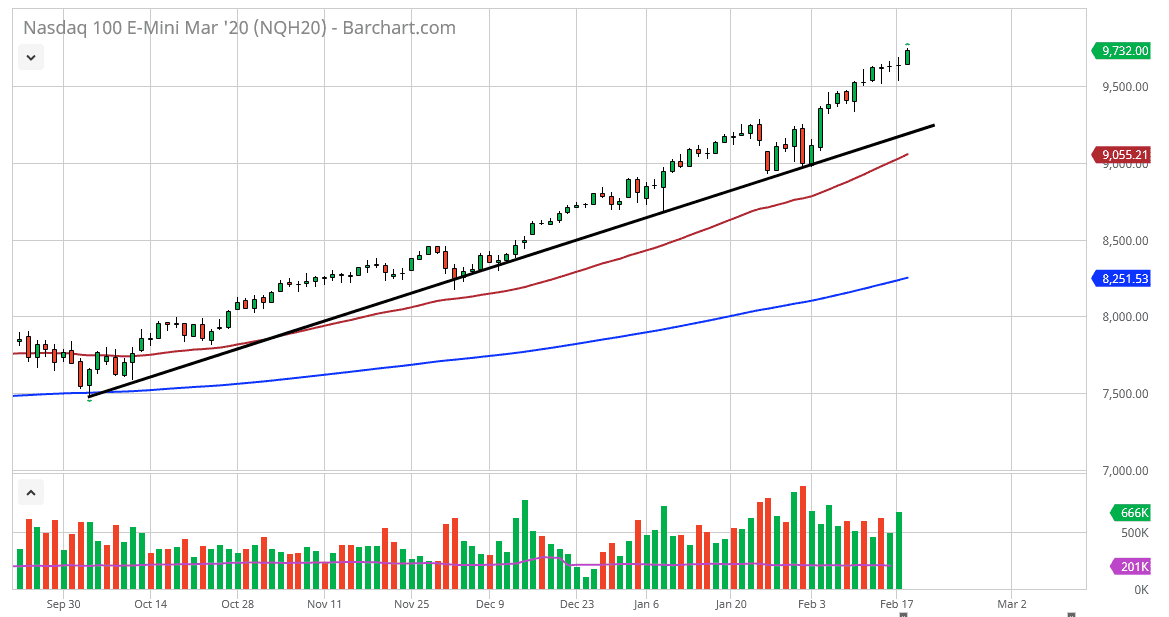

Underneath, the 9500 level should offer support, just as the uptrend line should. Ultimately, the 50 day EMA is underneath that line and offering support. Because of those factors I believe that buyers will continue to jump in based upon technical analysis as well. However, the market was to break down below the 9000 handle, then we could go looking towards the 200 day EMA. It’s difficult to imagine a scenario where we break down below there anytime soon, but there is always that threat. If the market breaks down below the 200 day EMA, then it’s likely that the market would unwind quite rapidly. That’s not my base case scenario but clearly the market will eventually have some type of issue that scares it. I do anticipate that a major amount of selling and supply will probably enter the market near the 10,000 level when we do get there.