The NASDAQ 100 has pulled back significantly during the trading session on Monday to kick off the week, but the selling continues to be seen more in the Globex market than the actual US markets themselves.

NASDAQ 100

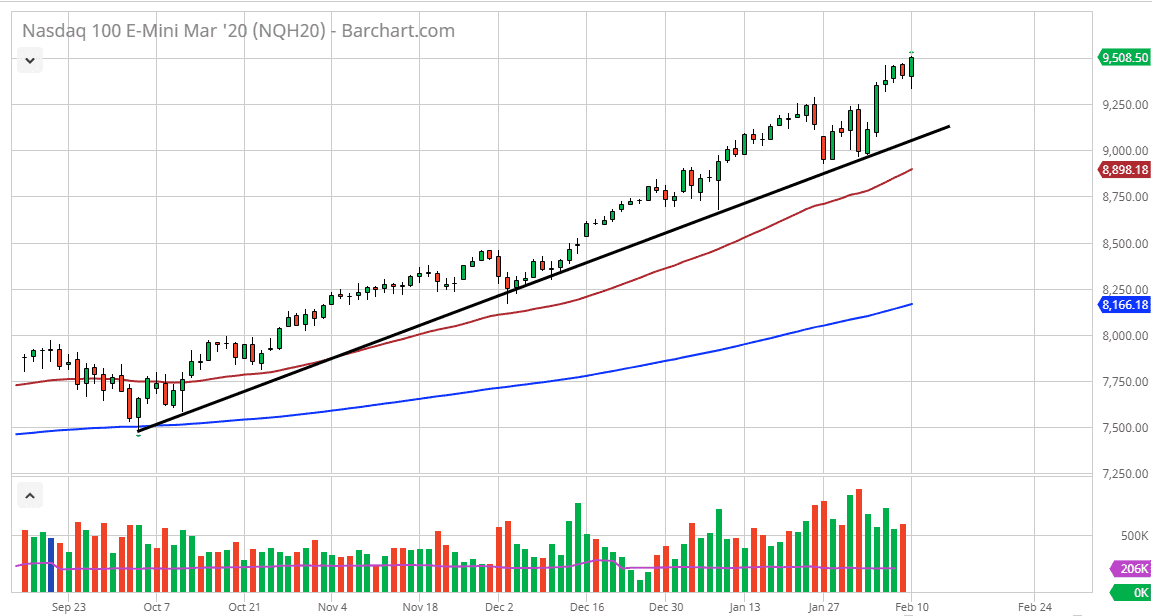

The NASDAQ 100 continues to see a lot of volatility but overall upward pressure. While we did initially pull back a bit during the trading session on Monday, the reality is that most of the selling is done during Asian trading. Most trading is local in nature, so as long as Asia continues to struggle, it will make sense that we could see a certain amount of negativity during those hours. However, US traders and to a lesser extent European traders, believe in the US situation, so therefore they are willing to buy these pullbacks as they come. I believe that the uptrend line should hold, but even if it doesn’t there it’s likely a lot of support at the 9000 level as well.

Now that we have reached the 9500 level, a little bit of a pullback does make some sense but given enough time we should break above there and go looking towards the 10,000 level for the longer-term move. After all, the only thing that markets truly care about is liquidity in the Federal Reserve seems to be more than willing to step in and provide as much as possible. If that’s going to be the case, then it’s likely that the buyers will return on every dip as they know no other strategy. Ultimately, every time this market drops a couple of hundred points, you should be looking for opportunities to get long.

The 50 day EMA sits just below the 9000 level as well, so that of course could cause a certain amount of support. If we were to break down below there, then the market probably unwinds quite a bit. Nonetheless, we are in a very well defined uptrend and therefore there’s no reason to think about shorting this market right now. The candlestick is closing at the very top of the range for the trading session, so that it does imply a certain amount of strength going forward, as the US market has been out producing most others in the world. Furthermore, we are in the middle of earnings season so there could be headline bonuses as well when it comes to upward pressure. I have no interest in shorting anytime soon.