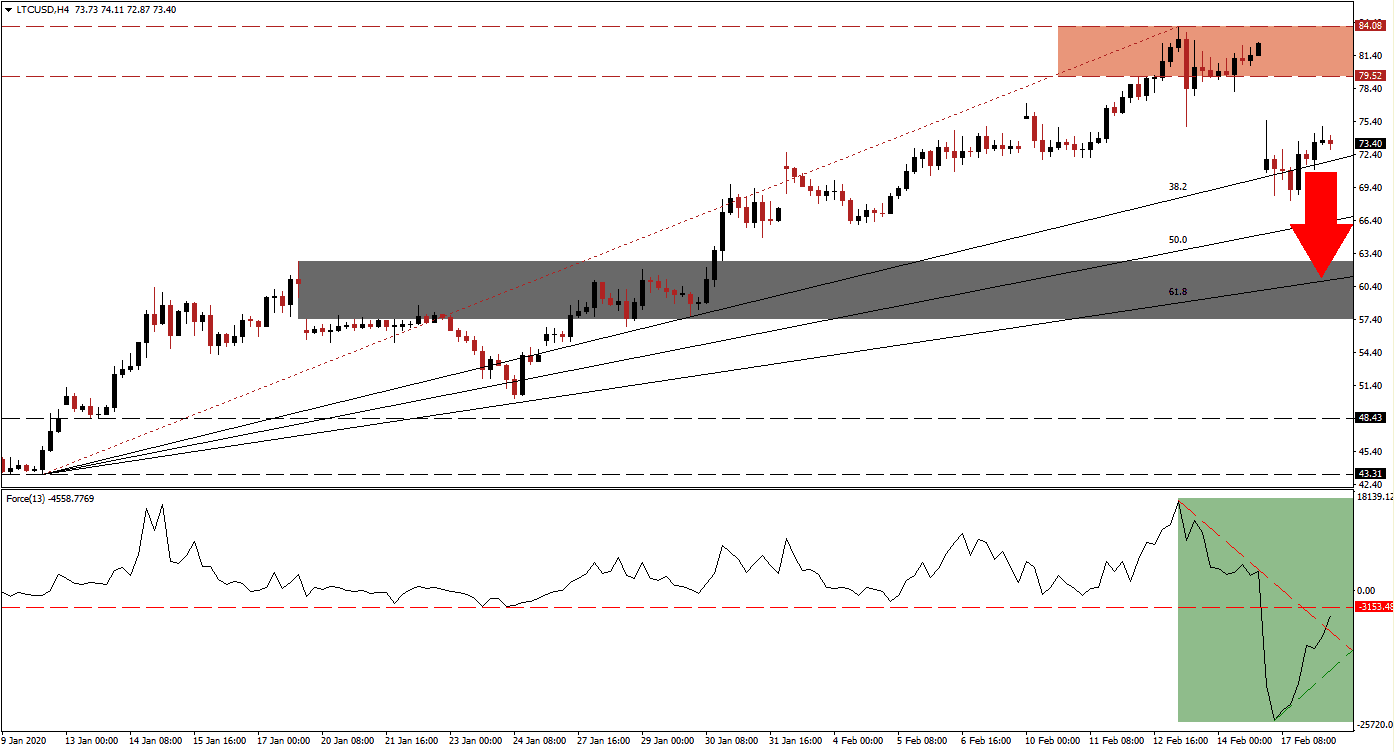

Litecoin has enjoyed a massive rally since the beginning of 2020, together with most established cryptocurrencies. This was reminiscent of the headline-chasing price action patterns that fed the previous bubble, resulting in what is now referred to as the Crypto Winter of 2018. The latest push to 2020 highs was fueled by fear of missing out, usually a sign that a correction is on the horizon. A 10% plunge this weekend left the LTC/USD with a price gap to the downside and resulted in a breakdown below its resistance zone.

The Force Index, a next-generation technical indicator, plunged to a new 2020 low as this cryptocurrency violated its bullish trend. A quick recovery followed, elevating it above its descending resistance level, aided by the emergence of a new ascending support level. The steepness of both has led to a convergence, suggesting that a reversal may materialize. This technical indicator remains in negative territory below its horizontal resistance level, as marked by the green rectangle. Bears are in control of the LTC/USD, and more downside is anticipated.

Price action provided traders an early warning sign after an initial breakdown below its resistance zone was reversed. The price gap emerged after a lower high inside this zone, located between 79.52 and 84.08, as marked by the red rectangle. This was followed by a temporary contraction in the LTC/USD below its ascending 38.2 Fibonacci Retracement Fan Support Level. A pause in the strong reversal is standard, but this cryptocurrency pair is well-positioned to extend farther to the downside from current levels. You can learn more about a price gap here.

One key level to monitor is the intra-day low of 68.27, the low of the developing breakdown sequence. A move below this level is expected to attract new net sell orders to the LTC/USD, adding fuel for an extended corrective phase. The next short-term support zone awaits price action between 57.44 and 62.74, as marked by the grey rectangle, which includes another price gap to the downside. With the 61.8 Fibonacci Retracement Fan Support Level passing through this zone, it is favored to enforce the long-term uptrend, ending the breakdown sequence.

LTC/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 73.50

Take Profit @ 62.00

Stop Loss @ 77.25

Downside Potential: 1,150 pips

Upside Risk: 375 pips

Risk/Reward Ratio: 3.07

A continued push higher in the Force Index inspired by its descending resistance level, which acts as temporary support, may fill the price gap in the LTC/USD. The upside potential for this cryptocurrency remains limited to its resistance zone in the short-term, while the long-term outlook carries a cautious bullish bias. An unlikely breakout will allow price action to challenge the psychological resistance level of $100.

LTC/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 79.00

Take Profit @ 84.00

Stop Loss @ 77.00

Upside Potential: 500 pips

Downside Risk: 200 pips

Risk/Reward Ratio: 2.50