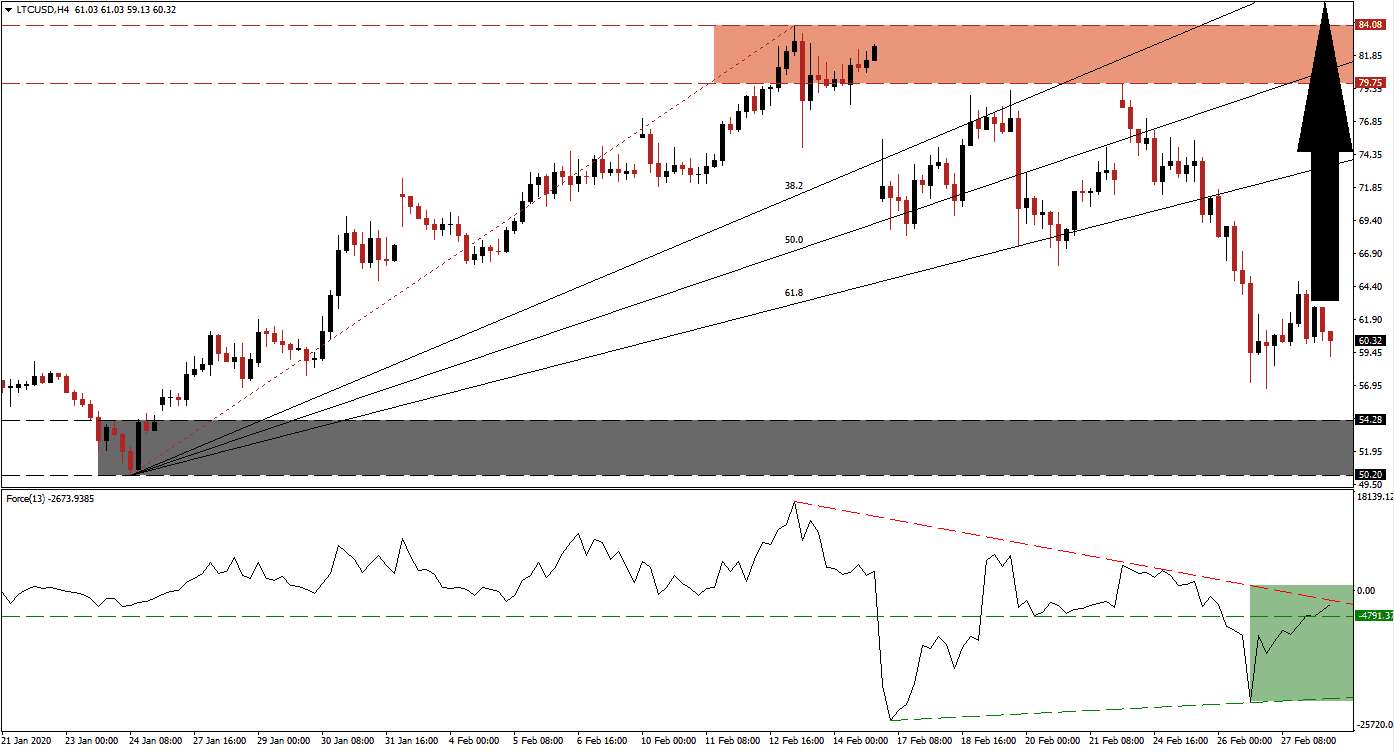

Volatility has returned to the cryptocurrency market. It also provided further evidence that this sector may not be as disconnected from the financial system as previously hoped. The sell-off coincided with the fastest market correction in US history, taking equity markets just six trading sessions to collapse by at least 10% or more. Such a move may occur on any given day in the cryptocurrency market, but the ripple effect does highlight the integration of it into the global system. Following the correction in the LTC/USD, a bullish momentum recovery emerged, suggesting a reversal just above its support zone.

The Force Index, a next-generation technical indicator, highlights the formation of a positive divergence. As this cryptocurrency pair contracted, the Force Index drifted higher, and an ascending support level materialized. A quick built-up in bullish momentum converted its horizontal resistance level back into support. Bears remain in control of the LTC/USD, but this technical indicator is now challenging its descending resistance level, as marked by the green rectangle. A breakout will allow bulls to take charge of price action, leading to a reversal. You can learn more about the Force Index here.

Price action halted its sell-off just above its support zone located between 50.20 and 54.28, a marked by the grey rectangle, with an intra-day low of 56.72. Sustained recovery from current levels will assist in the formation of a long-term bullish chart pattern due to its higher low. The LTC/USD will be positioned to enter a new breakout sequence if the pending reversal can eclipse its intra-day low of 66.00. Adding a significant bullish catalyst is the availability of Litecoin withdrawals across 13,000 ATMs in South Korea. You can learn more about a breakout here.

Another key level to monitor is the intra-day high of 64.77, the peak of the current bounce in the LTC/USD. A breakout above it is anticipated to inspire the next wave of net buy orders, allowing this cryptocurrency pair to close the gap to its ascending 61.8 Fibonacci Retracement Fan Resistance Level. The resulting higher high is then favored to pressure price action into its resistance zone located between 79.75 and 84.08, as marked by the red rectangle. More upside is expected to follow on the back of bullish fundamental developments.

LTC/USD Technical Trading Set-Up - Reversal Scenario

Long Entry @ 60.35

Take Profit @ 85.35

Stop Loss @ 53.00

Upside Potential: 2,500 pips

Downside Risk: 735 pips

Risk/Reward Ratio: 3.40

Should the Force Index collapse below its ascending support level, the LTC/USD is likely to attempt a breakdown below its support zone. Due to the bullish outlook in this cryptocurrency pair, any breakdown will provide traders an outstanding buying opportunity. The next support zone is located between 41.24 and 43.31, which includes three price gaps to the upside.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 48.35

Take Profit @ 42.00

Stop Loss @ 51.35

Downside Potential: 635 pips

Upside Risk: 300 pips

Risk/Reward Ratio: 2.12