After gold prices to the $1547 support in the beginning of yesterday's trading, it rose again to the $1562 resistance, and then stabilized around $1556 at the beginning of Thursday’s trading. The yellow metal is trying to stabilize its gains despite the gains of global stock markets, amid optimism of containing fears related to the spread of the deadly Corona virus of Chinese origin, and its threat to global economic growth, at a time when markets didn’t have time to celebrate reaching the Phase 1 trade agreement between the world two largest economies after a fierce tariff war between them for a period of 18 months, that was about to bring the global economy to the brink of recession.

The US dollar, which is moves in reverse with gold prices, got support after ADP data showed private sector jobs growing much stronger than expected in January 2020, supporting hopes that the Federal Reserve will keep its monetary policy unchanged in the coming months.

Data from the ADP showed that employment in the private sector increased by 291,000 jobs in January after increasing by a revised 199,000 jobs in December. Economists had expected employment to increase by 156,000, compared to adding 202,000 jobs that were originally announced in the previous month. The ADP data is an introduction to the US nonfarm payroll data, which will be released on Friday. The report is expected to show that the number of jobs increased by 161,000 in January, after increasing by 145,000 in December. The unemployment rate is expected to remain at 3.5 percent.

On the other hand, data from the Commerce Department showed that the US trade deficit widened in December. The US Commerce Department said the trade deficit rose to 48.9 billion dollars in December from 43.7 billion dollars in November.

Health experts do not know how far the Chinese virus will spread and how bad the crisis is, but global stocks are seeing a rise as if investors do not expect more damage from the virus to the global economy. On Wall Street, the S&P 500 index recovered all its recent losses and set a record high during Wednesday's trading session, and before that, stock markets rose in Japan and Hong Kong, near the center of the crisis. The gains came even as the number of infected people worldwide rose to more than 24,500 and the death toll rose to 491, and the vast majority of cases were in China.

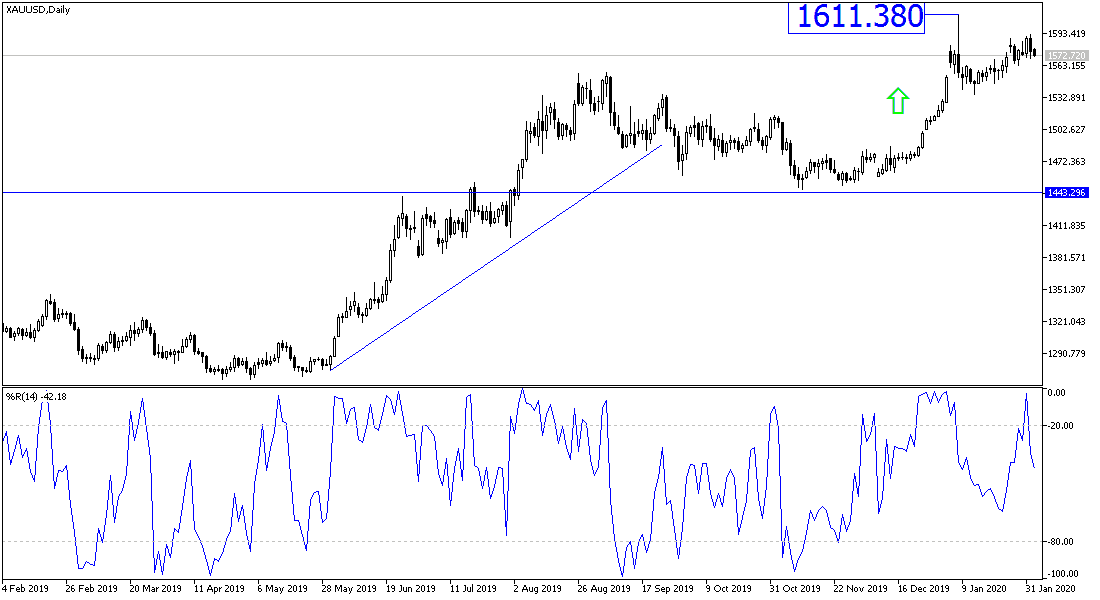

According to the technical analysis of gold: Despite the recent bounce, gold prices are still in the range of a bullish channel, supported by stability above $1500, and if prices stabilize below the $1547 support, which it tried to breach in the last three sessions, we may witness a move towards stronger support levels, with the closest ones being 1539, 1527 and 1520 respectively, and I still prefer to buy gold from each lower level until we finish completely from Corona virus and this will not happen overnight. For bulls, the $1,611 resistance is still the target.

Gold will react to what will be received from the testimony of the Governor of the European Central Bank Lagarde today and then the US data; the claims of the unemployed, and the developments regarding the losses of the Corona virus.