The recent and intensified measures by the Chinese government and the Chinese Central Bank to contain the situation and support the Chinese economy from collapsing due to the horrific losses for the spread of Corona virus in the country, especially with the resumption of the Chinese stock markets after a very long holiday. This situation put pressure on the gold price gains, which reached the $1592 resistance. Prices witnessed a temporary downward correction to the $1572 support, where it is stable at the time of writing. Gold is still in an upward trajectory and the Corona virus is not over yet.

The economic situation in the second largest economy in the world is scary. If China’s industrial parks remain closed during the next few weeks - a possibility that may be very natural - retailers, car companies, and Western manufacturers that rely on Chinese imports will begin to run out of the goods on which they depend. In order to meet the summer commodity deadlines, retail experts say that Chinese factories will need to increase production by March 15. Wuhan, the Chinese city that was the source of the Corona virus, is a vehicle production center, and they were closed down, along with the neighboring cities, which led to the isolation of more than 50 million people and stopping factories in those areas.

Therefore, economists sharply lower the outlook for the Chinese economy, the second largest in the world. Tommy Wu and Louis Quijs of Oxford Economic University lowered their forecasts for Chinese economic growth this year from 6% to 5.4%. They expect most of the damage in the first three months of 2020.

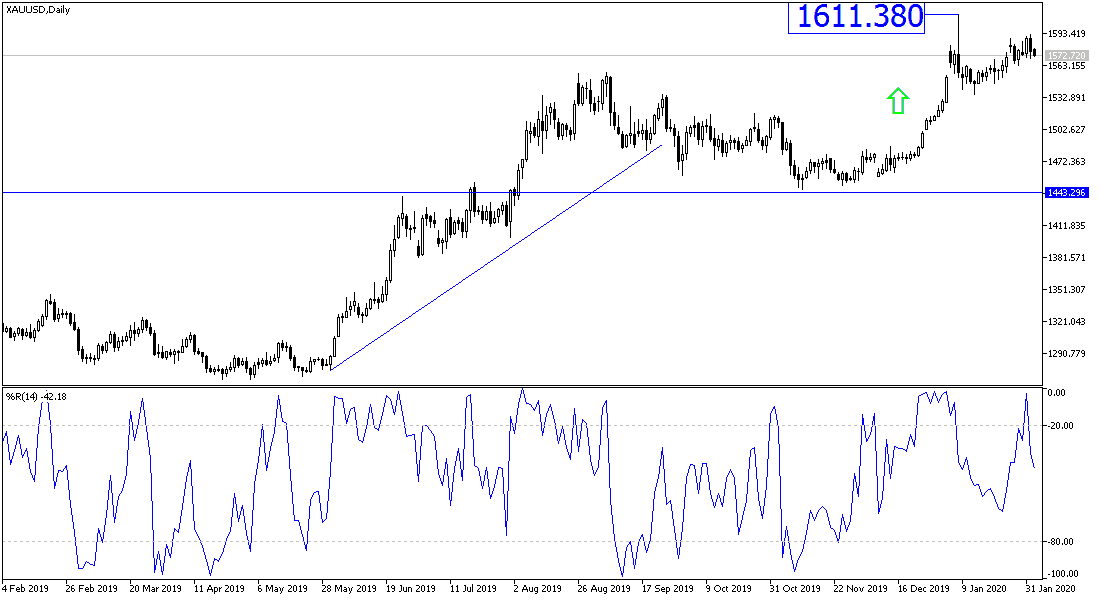

According to the technical analysis of the gold price: Despite the recent rebound in prices, gold prices are still moving within a bullish channel, and we expect the return of purchases from the support levels at 1566, 1557 and 1545, respectively. Containing the global consequences of the Coronavirus will take more time and increase losses, which means more investor appetite for safe heavens, with the yellow metal being one of the most important of them. The bullish path is still possible to move to the following resistance levels at 1583, 1592 and 1611, respectively. I still prefer buying gold from every downtrend.

As for the economic calendar data today: Economic data is few, and most important data, which gold may interact with are the Reserve Bank of Australia announcement of their monetary policy and interest rates, then the construction purchasing managers ’index from the United Kingdom, and American factories’ orders data.