Since the outbreak of Corona virus and safe havens are the biggest winners. Gold prices recorded gains reaching to the $1592 level, near their highest level in seven years, before the price of the yellow metal settled around the $1578 level at the time of writing. The pair may target the last resistance at $1611, and bypass it significantly if the consequences of Corona virus worsen to stagnate the global economy. China opened a newly created private hospital in just 10 days to follow up and treat those with coronavirus infection. It sent medical workers and equipment to the hospital, put money into the financial markets and imposed more restrictions on the movement of people in new, comprehensive steps taken Monday to contain the rapidly spreading virus and its growing impact.

Updated numbers from China reported 361 deaths and 2829 new infections over the past 24 hours, bringing the total number of infected in China to 17,205 cases, while other countries continue to evacuate their citizens from the worst-affected Hubei Province and restrict the travel Chinese or People who have recently traveled to the country. The World Health Organization said the number of cases will continue to grow because tests are pending on thousands of suspected cases.

In a sign of economic losses for the second largest economy in the world, the Chinese Shanghai Composite Index fell 8.7% when it reopened on Monday after the lunar New Year holiday. But later settled after the People's Bank of China decisions to pump money. "We are fully confident in the impact of the epidemic on the economy and its ability to do so," Lian Williang, vice chairman of the National Development and Reform Commission, told a news conference in Beijing.

In Hong Kong, thousands of health care workers threatened to strike on Tuesday unless the government agreed to the talks before 6 pm. Hong Kong has registered 14 cases of the virus and cut flights, train and bus links to China. In Beijing, officials sought to reassure the country's 1.4 billion people with adequate supplies of face masks and cleansers, despite the reported shortages in many parts of the country.

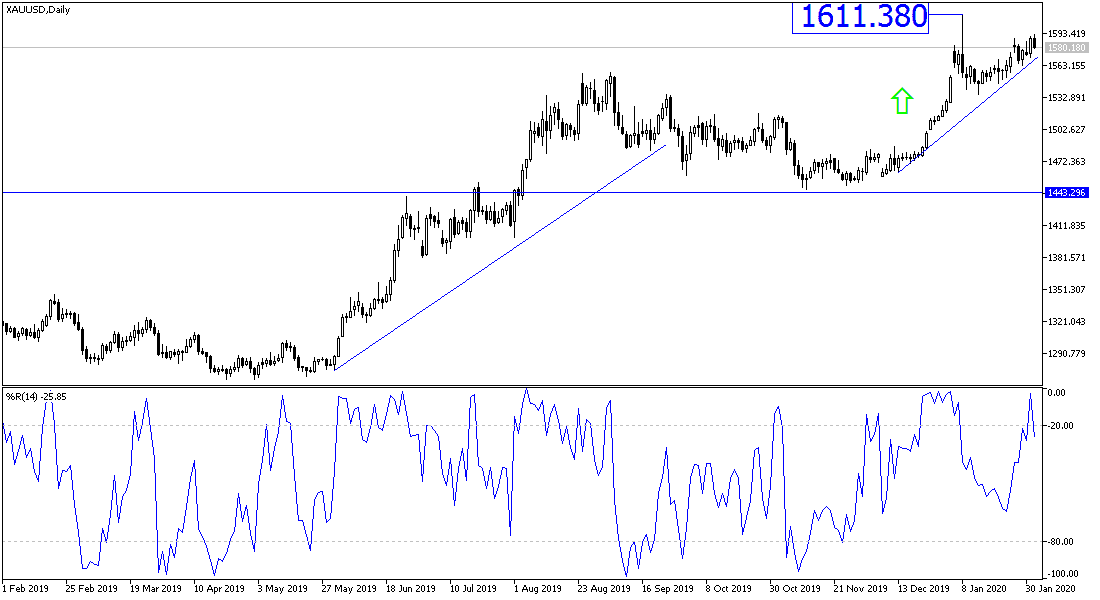

According to the technical analysis of the gold price: The general trend will remain in the range of a bullish channel supported by stability on top of the $1500 psychological resistance, and is now ready to penetrate the following psychological resistance at $1611 an ounce, which it recorded at the beginning of January 2020, and the highest for gold in seven years and even stabilizing above that. The global spread of the Corona virus will remain in support of gold gains for a longer period. On the downside, the closest support levels to gold prices, and the most appropriate to buy it now, are at 1569, 1555 and 1540, respectively. I still prefer to buy gold from every bearish level.

The yellow metal will react to developments on the ground from the Coronavirus, along with the announcement of the US ISM Manufacturing PMI.