In the beginning of this week’s trading, the price of gold rose to the $1659 level, with a 1.8% increase, and reaching the highest level in seven years. In the same trading session today, and despite the losses of all global stock markets, the gold price has tumbled to the $1651 level, and from there to the $1633 support in morning trading today, amid profit-taking selling operations after the pace of continuous gains. Corona's human and economic losses around the world led by China, the source of the epidemic, have been a good reason for gold to achieve those gains which are the highest since 2013. On Wall Street, the Dow Jones index fell more than 900 points in early trading Monday noon, while in Europe, the Stoxx600 index in Europe fell 3.6% after increasing Corona cases in Italy. Cases were announced in new countries in the Middle East.

The outbreak that started in China has infected more than 79,000 people worldwide. The WHO called the epidemic COVID-19, and in China, the source of the epidemic, it killed 2,592 people and infected 77,150 people. In Japan, 838 cases and 4 deaths, in South Korea, 833 cases and 7 deaths, and in Italy 220 cases and 5 deaths. In Iran, 61 cases and 12 people died. This was the last figure recorded from China and outside its borders, with much smaller numbers in other countries.

On the economic side. Pessimistic expectations continue, on the part of international companies, governments and even global central banks, in the event of a prolonged outbreak of the epidemic, and it was not brought under control soon. The Chinese economy is linked to all world economies, east and west.

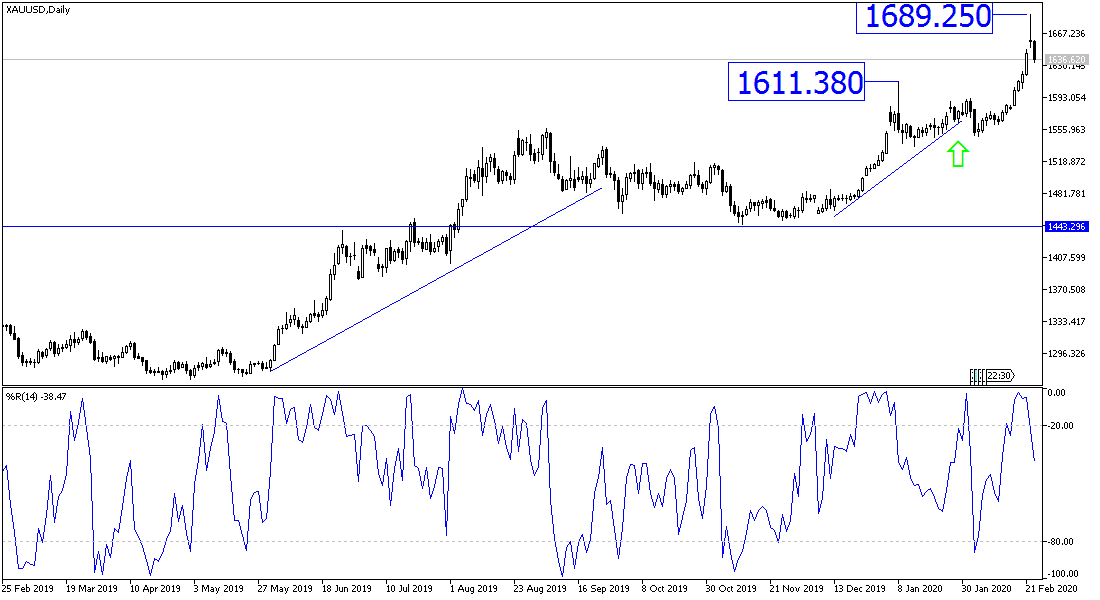

According to the technical analysis of gold: the price of the yellow metal is still on an upward path in the long and medium term. In a phase of a bearish correction in the short term, after it retreated from the $1689 resistance, its highest level in seven years, to the $1633 support, this morning. The reversal will be confirmed if the price returns below the $1600 level. We have often mentioned and confirmed in recent technical analyzes that gold is in strong overbought areas and that the bounce to correct for profit taking will be strong. Nevertheless, gold will remain a safe haven and favored by investors as long as the Coronavirus concerns persists.

Gold will react today with the announcement of the US Consumer Confidence Index.