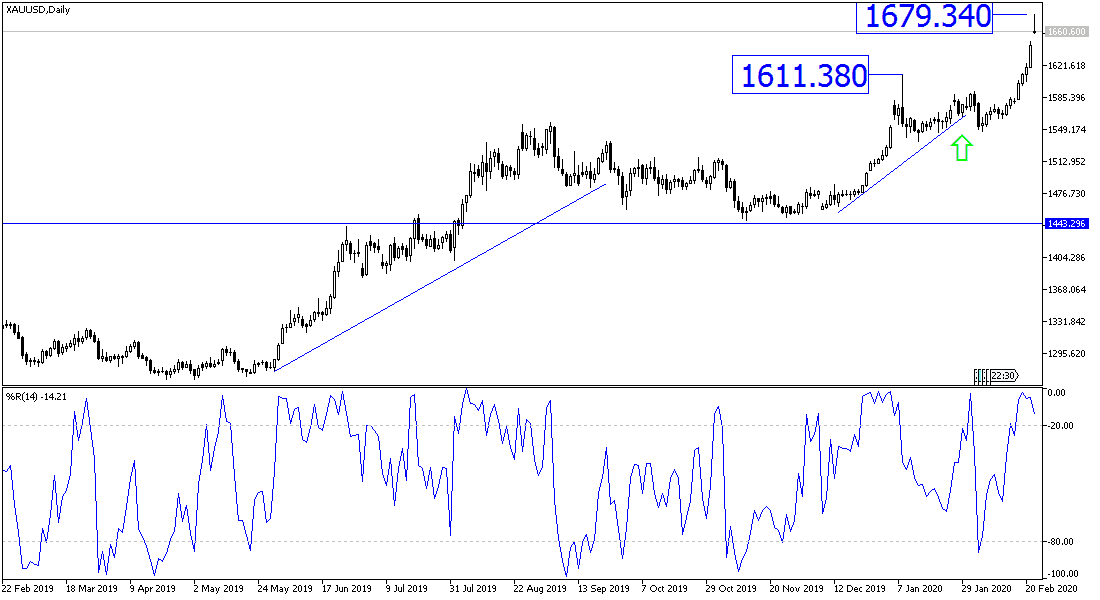

Larger and continuous losses caused by the Corona virus (Covid-19) = new historical and record gains for gold. The losses from China turned to Japan and South Korea, which paved the way for record and historical gains for gold prices that culminated by testing of the $1649 resistance, its highest level in seven years, before closing the week's trading around the $1643 level. At the beginning of this week’s trading, the price gapped higher towards $1679, before settling around $1662 at the time of writing. Forex traders wonder about the most appropriate level of selling, especially with the gold gains continuing without stopping. The answer depends on allaying global markets' concerns about the future of eradicating the epidemic that threatens global economic growth. The announcement of a vaccine that ends in the virus and that has already proven its efficacy, will be translated into violent gold sales, because the technical indicators have all reached strong overbought areas.

The number of confirmed corona cases has risen to more than 76,000, with 2,250 deaths, and the number is constantly increasing. The epidemic tsunami has crossed the Chinese borders, the world's second largest economy. The upcoming Summer Olympics in Tokyo is at stake, and he has joined many important economic events in China and its neighbors, as well as the announcement by international companies of their business and profits being affected by the crisis in China.

It was surprising for traders to see gold prices rise at the same time when the US dollar was rising strongly. Last week, US Federal Reserve Chairman Jerome Powell reiterated that the bank believes the economy is in good shape and is satisfied with the current range of the interest rate between 1.5% and 1.75%. As is well known, this rate affects many consumer and commercial loans. The gap between investor expectations of a rate cut and policymakers ’expectations has posed a long-term dilemma for the Fed. As the central bank tries to guide markets about what it may or may not do in the coming months. However, they are also studying signals from the markets on how the economy is going and the Fed's interest rate policy is going.

And if the Fed ignores investor expectations for lower interest rates, market losses may worsen - especially if the central bank turns out to be wrong in its economic assessments. On the other hand, if Fed officials have designed their policies primarily to satisfy traders, this could risk inflating risky asset bubbles. At a conference last Friday in New York, sponsored by Booth School of Business at the University of Chicago, Loretta Mester, Federal Reserve Chair in Cleveland, suggested that the Federal Reserve listen closely to market signals.

Mester said monetary policy makers "should be open-minded to reassess their view of the economy on the basis of all the information provided, including those of participants in the financial markets." And that "we have to be open to the possibility that the view of markets is more in line with the fundamentals from the policymakers’ point of view." Meester is a voting member of the Monetary Policy Committee this year.

According to the technical analysis of gold: On the daily chart, the price of gold has reached strong overbought levels, and the correction awaits profit-taking sales from these levels, and the correction will be stronger if optimism returns to the financial markets due to finding a vaccine that ends the Corona virus epidemic. For the next levels; on the upside, the aggravation of the crisis and the increase of gold purchases may support testing of new highs, the closest ones being 1655, 1672 and 1700, respectively. Market sentiment is an important factor affecting the price of gold at that point. Given that the bearish correction will be violent.