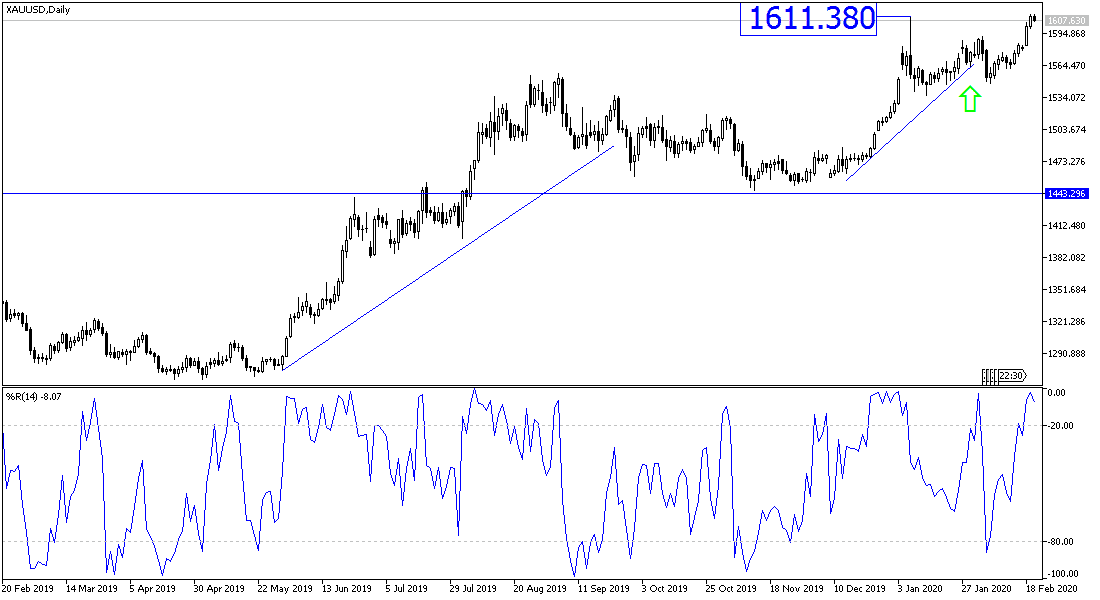

Gold performance continues with a steady upward momentum since the beginning of trading in 2020. The price of an ounce of gold jumped during yesterday's session to the $1613 resistance, its highest in seven years, exceeding the $1611 resistance barrier, which was recorded in the beginning of trading in January 2020, from which it returned to the $1535 support after the formal signing of the Phase 1 trade agreement between the United States of America and China. Corona epidemic spread, Covid-19, supported the launch of gold prices from the $1545 support to its current gains. The price of gold has increased by more than 6% since the beginning of the year and has increased by 20.2% during the past 12 months, and after recent gains, expectations for the possibility of more gains have increased by 5% by mid-May.

Gold prices are believed to have benefited this year from the increased demand for safe haven, amid uncertainty about the impact of the Coronavirus on the global economy. However, prices have been on the rise since October 2018 when the Fed indicated that the rate hike cycle was approaching, which encouraged speculation of a fall in the US economy and the dollar. Commerzbank believes that the price of gold should remain in an uptrend as long as it is above $1535 and that once it reaches the $1704 height on a closing basis, the market can then turn its attention to heights at $1734, $1796 and $1803 respectively. As long as the current upward trend continues, we cannot be ruled out a return to an all-time high of $1921, which was the level experienced in 2011, from the technical perspective of the bank.

On the economic side. Despite the world panic over the consequences of the Corona epidemic on the future of global economic growth, the US economy is enjoying its continued strength because it is not directly related to the Chinese economy, as is the case with the rest of the other global economies, like Japan, the European Union and Australia. US economic figures continue to support the US central bank's confidence in the country's economic performance and thus stick to its monetary policy for a longer period.

According to the technical analysis of gold: The general trend of gold prices will remain in the range of an ascending channel as long as it remains stable above the $1550 resistance at the present time. Breaching the highest psychological resistance at $1,600 will remain supportive of bulls controlling performance for a longer period. The current levels remind the markets of the 2013 levels, which were higher than the current prices. And all of this will depend on the course and continuity of the Corona epidemic. According to the performance of the technical indicators, the prices reached strong overbought areas. Accordingly, the correction may be violent and profitable, especially when a vaccine is announced that ends Corona. The closest support levels for gold are currently 1596, 1585 and 1570, respectively.

As for the economic calendar data today: After the announcement of the Australian job numbers, the focus will be on the British retail numbers and the Philadelphia Industrial Index and the unemployed claims from the U.S.