During last week’s trading, there were more investors seeking to buy safe havens (gold, Japanese yen and to a lesser extent, the Swiss franc), with increasing losses due to the outbreak of the Coronavirus in the second largest economy in the world, and its expansion to many countries around the world. This is in addition to the renewed political tensions in Germany, the United States and Britain, and these factors were catalysts for gold investors to push prices to the $1585 resistance, near its highest level in seven years. COVID-19, the name of global epidemic, has exceeded 1,600 deaths and infected more than 68,000 cases in China alone. The Chinese government does not stop taking further measures to contain the crisis situation. The last of these measures, senior officials of the ruling Communist Party in Hubei and Wuhan were sacked and replaced last week.

Despite the Chinese measures. Many, including the White House, have expressed concern about transparency from China, noting that US health personnel have not yet been allowed in. The Financial Times quoted a famous epidemiologist in London expressing concern that only about a tenth of the cases might be detected correctly. In Wuhan, it is suggested that the screening process may be more extreme, as it affects one out of 19 cases. On the economic side, the results of the Chinese economic data for January and February will be distorted by the Lunar New Year holiday this year, due to the new Coronavirus (Covid-19), the data will therefore be of very little value in the market.

Economists warn that optimism about controlling the epidemic is premature. Even if the auto industry and other businesses resume as planned, the activity will not return to normal until at least mid-March. The losses are expected to be so great that experts have lowered estimates of China's economic growth. Economists, including Capital Economics, believe that growth, which has already reached its lowest level in several decades, may drop to 2% in the three months to March, down from the official quarterly figure of 6%.

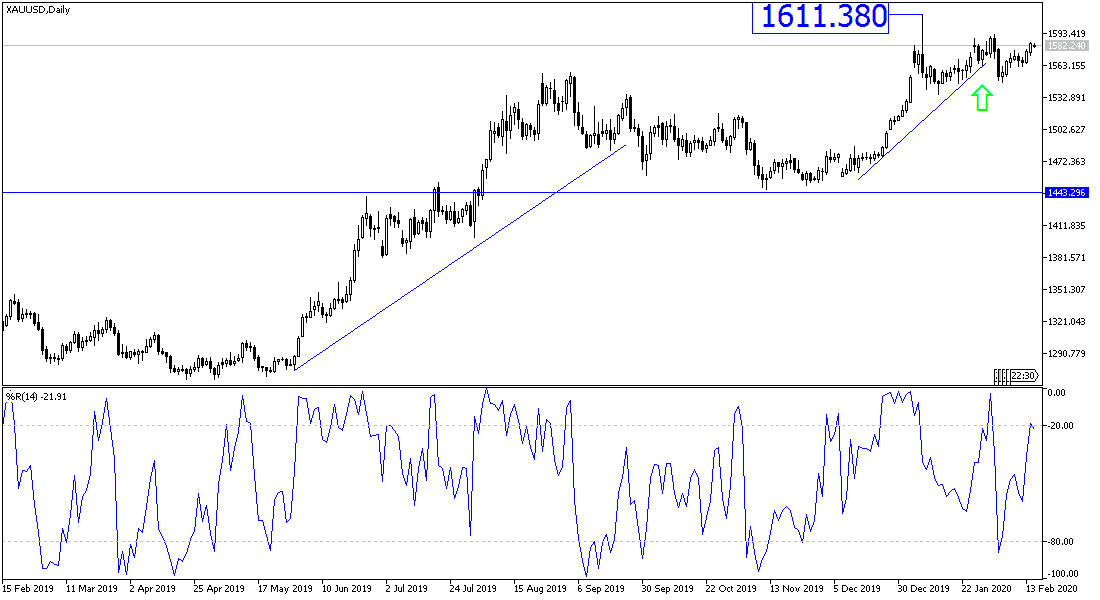

According to the technical analysis of gold prices: As we expected before, we now confirm that gold prices are still inside the formation of a bullish channel and the recent global developments may push the price of gold to the $1611 psychological resistance very soon. Yellow metal purchases do not stop while the Coronavirus persists. Prices ignore the technical indicators reaching overbought areas, as bull control factors are increasing. There will be no bearish correction of gold prices without a break below the $1550 support in the near term. We expect quiet moves at the beginning of this week's trading in light of the American holiday, while observing the developments of the Covid 19-Chinese epidemic.