Gold prices rose again since the start of trading on Thursday, reaching the $1576 level after the price fell to the $1562 during yesterday's session, despite the Chinese messages to the world, and by the Chinese president, that the corona situation is under control and that the virus is at its peak and the situation will be completely contained by next April. The price of gold also ignored the strength of the US dollar as a result of the incentive testimony by Jerome Powell, Governor of the US Central Bank, for two consecutive days, during which he stressed the strength of the US economy and that the impact of the Corona virus is still limited and that the bank is monitoring developments and is ready to do the necessary. Recent reports indicated a decline in cases of infections and death, in contrast to the early days of the epidemic.

But gold investors had another opinion. The yellow metal will be preserved until the final announcement on the elimination of the Corona virus, the second largest economy in the world is still closed to the rest of the world. No travel, no tourism, shy commercial exchange, and a quarantine of everything that is Chinese. Fears also increased after the health reports that symptoms of the disease may appear in a longer period than was initially determined from 14 to 45 days, which means that the month of April set by the Chinese president is far from reality.

Forex trader cautiously watched the testimony of Jerome Powell, which in its entirety was in favor of the US dollar, which is reversing against gold, and in light of the Corona crisis, this theory is dwarfed. The Federal Reserve cut the key interest rate three times last year to its current range from 1.5% to 1.75%, which is a historically low level, to counter the global economic slowdown and push inflation higher. Powell said in prepared statements that the rates at this level "will support the continued economic growth and a strong job market" and return the annual inflation to the target level of the committee at 2%.

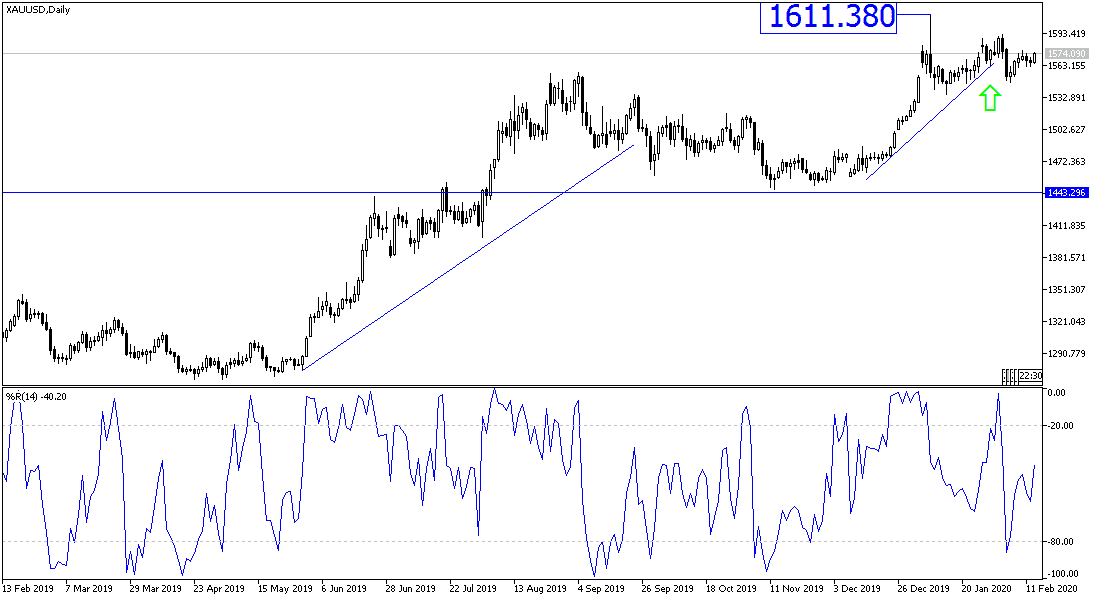

According to the technical analysis of gold: Gold prices are still moving inside a bullish channel, and the bulls target is still the $1611 psychological resistance, its highest for more than seven years, and they are looking for negative developments due to the Corona virus, the world’s most recent topic, to push the price to that peak. The closest support levels for gold prices are currently 1564, 1554 and 1540, respectively. I still prefer to buy gold from every bearish level. The gold price will react today to the announcement of US inflation figures, consumer prices, as well as jobless claims.