China's continued losses from the Coronavirus, along with increasing concerns of monetary policy makers of global central banks, may give gold prices the green light to launch for stronger gains, or at least maintain its current momentum, that pushed it this week towards the $1577 resistance before settling around $1566 in the beginning of today’s trading. The global economy began to be affected negatively by the losses of the second largest economy in the world, due to the outbreak of the Corona epidemic. After the airlines, tourism and restaurants stopped, international mail joined the list of losers due to the Coronavirus. The US Postal Service informed its counterparts around the world that it was "facing great difficulties" in sending messages, parcels and express mail to China, including Hong Kong and Macao, and explained the fact that most of the supplied airlines have suspended their flights to those destinations. In a statement to the Associated Press, the World Postal Union said that suspending flights due to the virus "will affect the delivery of mail in the foreseeable future."

Because of Corona and global concerns, Federal Reserve Governor Jerome Powell has expressed his concerns that the US and global economy will be affected by the outbreak. In his testimony before the House Financial Services Committee, the Federal Reserve Chairman said that the US economy appears solid, with continued growth and unemployment near the lowest levels in half a century, but it faces risks from the spread of the virus that started in China.

Powell stressed that the Federal Reserve is watching developments caused by the Coronavirus, and warned that "it could lead to turmoil in China that spreads to the rest of the global economy."

Several lawmakers also asked Jerome Powell how the Federal Reserve was dealing with climate change. Representative Sean Kasten, a Democrat from Illinois, stated that changing weather patterns and rising sea levels could threaten banks that provided mortgage loans for homes in coastal areas. Powell replied that banks should take this into account and later recognize that climate change may ultimately affect the Fed's policy.

China's losses from the Coronavirus so far reached to 1,016 confirmed deaths and more than 40,000 infected cases. The virus spread in more than 20 countries around the world besides China, the source of the epidemic.

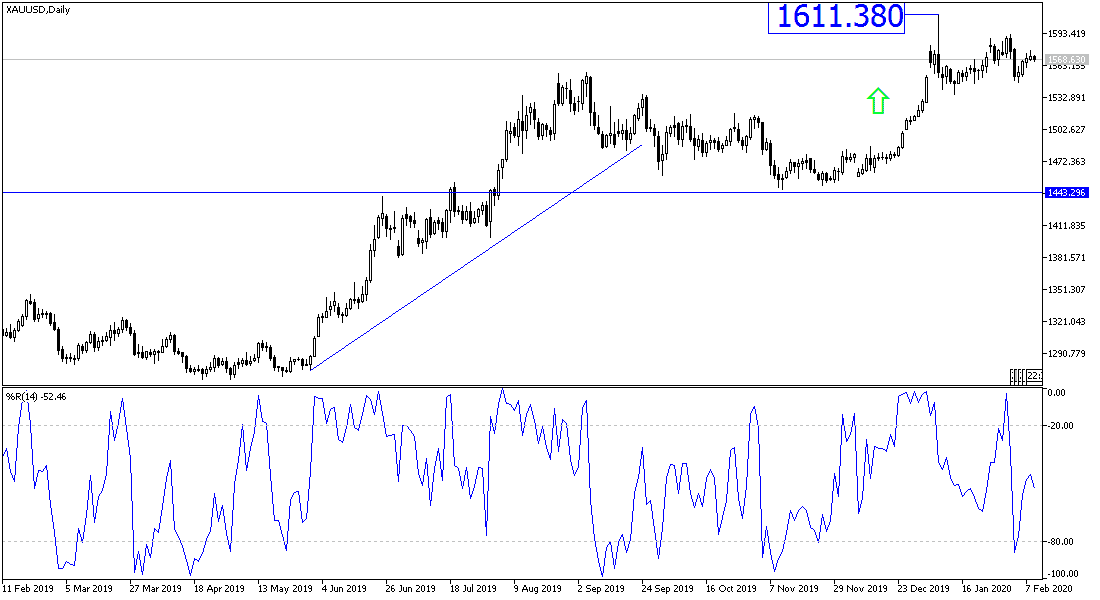

According to the technical analysis of gold: On the daily charts below, the price of gold is still in the range of a bullish channel and the head and shoulders formation began to form, and with the absence of new incentives for bulls to push prices up, the gold price may be subjected to temporary profit taking sales, and this confirms that technical indicators have reached overbought areas. The most recent resistance levels for gold are 1574, 1589 and 1611, respectively. A reversal of the trend may only occur when the price moves towards the $1530 support, otherwise the trend will remain upward, and I still prefer to buy gold from each upside level.

With the absence of important economic releases during today's trading, gold traders will focus on the second testimony of Federal Reserve Governor Jerome Powell and the developments of coronavirus losses around the world, especially from China.