Despite the positive results of the US jobs report for January, the price of gold managed to rebound up to the $1574 resistance level an ounce during last Friday's trading session, and closed the week's trading around the $1570 level. This is due to the rising global concerns about the worsening of the situation in China due to the outbreak of the Coronavirus. Until now, no anti-virus vaccine has been announced, and the number of victims is increasing, whether by death or infection, and infection has spread to more than 20 countries around the world besides China, the original source of the virus. The yellow metal is an ideal safe haven for investors in times of uncertainty, as is the case now with the world’s concerns about Corona.

The situation in China remains worrying despite successive statements from the Chinese government to reassure citizens and the world. Despite recent measures by the People's Bank of China to revive the world's second largest economy from the disaster, which wiped out about 400 billion dollars’ worth of shares traded in Chinese markets, halted many factories and besieged 60 million people to contain the spread of the disease. The death toll exceeded 800, surpassing that of the SARS virus. It is another viral outbreak that originated in China. In all, more than 37,198 confirmed cases of the new virus have significantly exceeded 8,098 SARS patients.

The Chinese government announced that a 1,500 bed hospital was built in two weeks in Wuhan, and another 1,000 bed hospital was built in 10 days last week. The city government, with a population of 11 million, has said it will begin sanitation operations twice a day for hospitals, markets, public toilets and other facilities.

Despite the apparent economic strength in the US jobs report, analysts warn that US employment may slow in the coming months. As the January jobs report was compiled before the spread of the Coronavirus, which caused thousands of cases in China, closed shops and factories there and led many international companies to suspend operations in China. This, along with Boeing's decision to halt production of its 737 MAX aircraft, has not yet affected overall job growth. But some Boeing suppliers have announced layoffs that could appear in the job report next month.

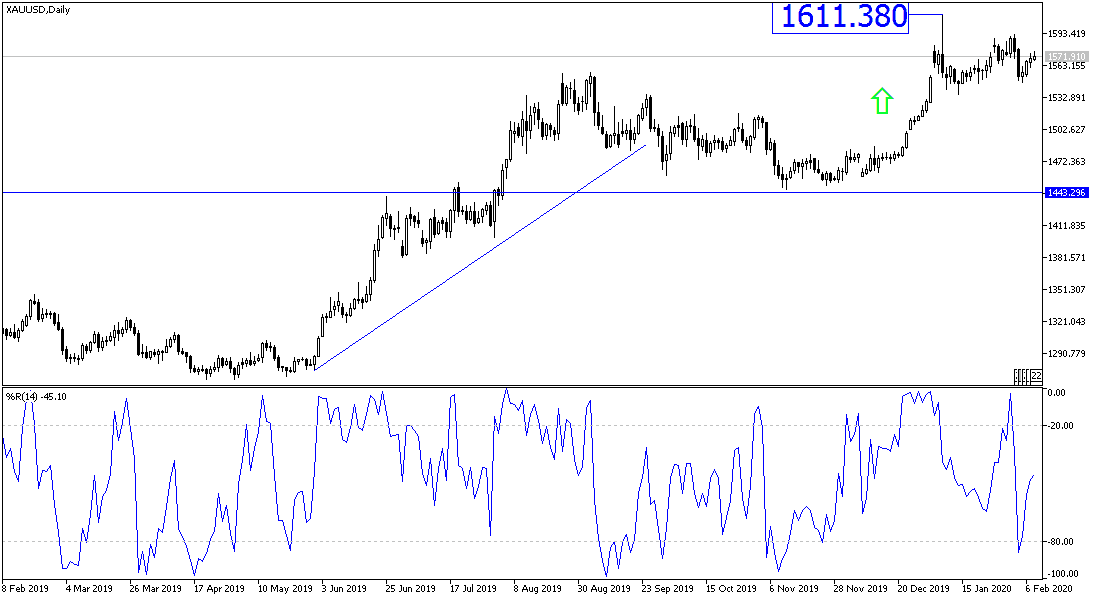

According to the technical analysis of gold: On the daily chart, the price of the yellow metal is still moving inside a bullish channel with the support of stability above the $1500 resistance and the metal ignored the technical indicators reaching overbought areas. Increased global tensions from the Corona pandemic and the failure to reach a vaccine may give the gold price the momentum needed to move towards the following psychological resistance at $1611 an ounce, the highest in seven years. I still prefer to buy gold from every downtrend, and the closest support levels are currently at 1550, 1535 and 1520, respectively.

Today, the price of gold may move in a limited range, as the economic calendar contains no significant and influential data, and investor sentiment will determine the performance, which is still bullish.