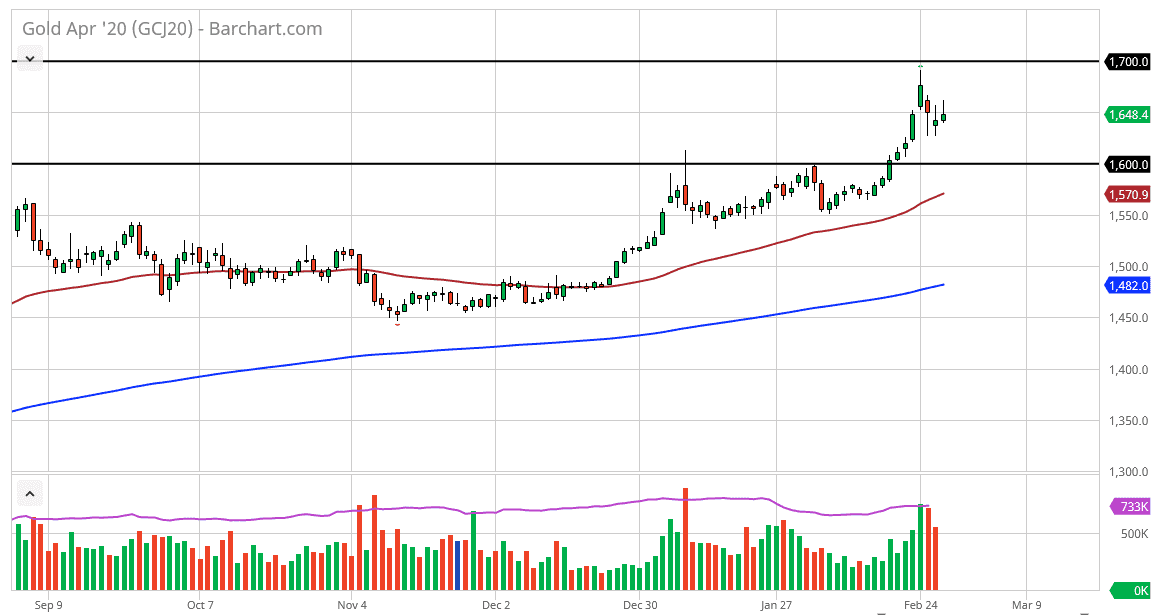

The gold markets rallied a bit during the trading session on Thursday, breaking above the $1650 level. That is an area that of course offers a lot of psychological important. It’s essentially “fair value” between what looks like the resistance area at the $1700 level, and the support level at the $1600 level. The shape of the candlestick isn’t necessarily overwhelmingly positive, but the trend itself is higher and therefore one has to assume that will continue.

There are a lot of concerns when it comes to the coronavirus obviously, and gold is a way to perhaps mitigate some of the risk in general. That being said, the gold markets are also being propelled by not only the worries of a global outbreak, but the central banks around the world continuing to loosen monetary policy. That of course is good for gold, as fiat money loses value. The trading world is starting to price in the idea of three interest rates coming out of the Fed, which has of course the idea of buying gold very attractive.

At this point, I do believe that the $1600 level will act as a bit of a floor in the market, especially as the 50 day EMA starts to reach towards it. If it does in fact break above there, then the floor should simply move higher. The $1700 level above being broken would be a very bullish sign and could send this market towards the $1800 level, an area that I had been looking for in the past, due to longer-term technical analysis. I still believe we get there one way or another, but it may be more to do with central banks than the virus by the time it’s all said and done. Either way, there is nothing on this chart that tells me you should be selling gold so therefore I will be doing so. In fact, I’d be a bit surprised if we did break down below the $1600 level. If we did, then I think the $1550 level would be the next support level. All things being equal, this market should eventually turn around and I think a lot of traders out there will be looking to take advantage of value as it presents itself. Buying the dips has been working for some time, and even though we have seen some of the gains disappear late in the day, I still believe in value trading.