Gold markets broke higher during the trading session on Wednesday, finding the ability to go to a fresh, new high. Because of this, it looks like the gold market is going to continue to go much higher, which makes quite a bit of sense considering that the central banks around the world are going to continue to loosen monetary policy. That is like rocket fuel for gold, but furthermore we have a lot of concerns when it comes to global growth and of course geopolitical issues.

Furthermore, the coronavirus continues to grab the headlines and people of course are concerned about that. With that in mind it makes quite a bit of sense that the gold markets get a bit of a safe haven bid. This is especially telling considering that the US dollar has also been rallying, and therefore it shows just how concerned the world is right now. Typically, if gold rallies it works against the value of gold, but at this point it’s all about fear more than anything else. Now that the market has shown quite a bit of strength and has broken above the most recent high, it’s very likely that the market will go looking towards the $1800 level longer-term but it’s probably going to take some time to get there.

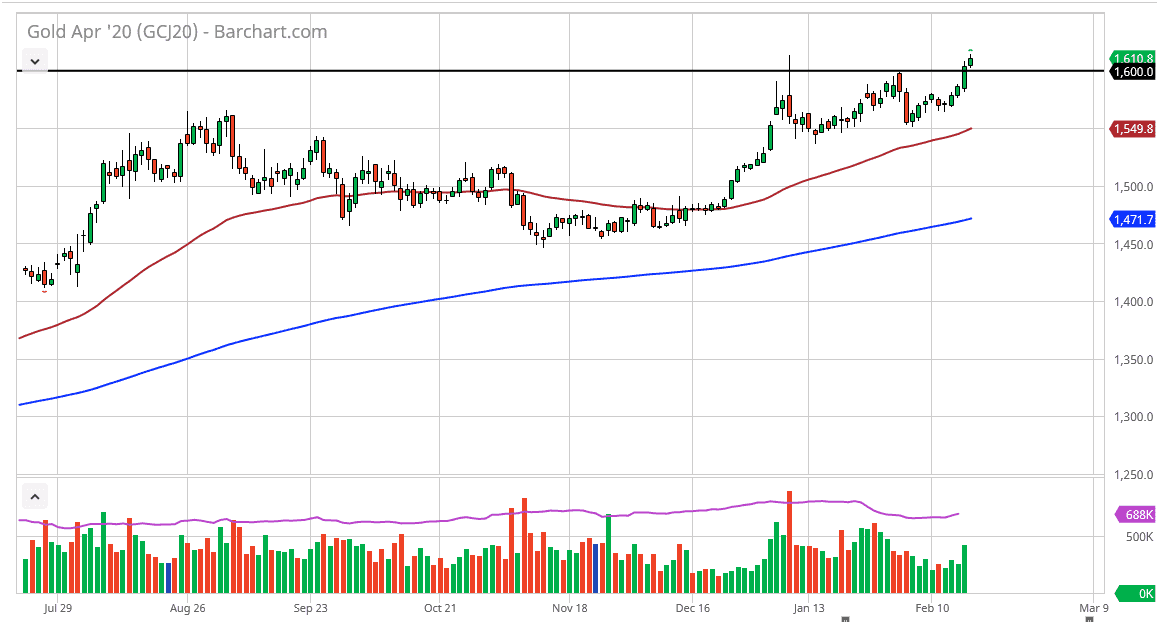

To the downside I expect the $1550 level offer plenty of support, right along with the 50 day EMA. Pullbacks at this point are probably going to continue to be value, and therefore it’s likely that the market will find plenty of reasons to go higher. Selling is all but impossible, and quite frankly there would have to be some type of major shift in attitude for gold to suddenly selloff. If the market did break down below the $1550 level, it’s possible that we could drop as low as the 200 day EMA which could be closer to the $1500 level. That being said, if we were to break down below there that would be the signal that the market is falling apart. Quite frankly, we would need to see some type of massive “risk on” scenario in order for gold to suddenly be out-of-favor. It has shown a lot of resiliency over the last several months and should continue to do so going forward. Buying on dips and building up a larger position has been my strategy for some time and should continue to be so.