This week’s economic data out of South Africa provided clear evidence of how the Eskom crisis damaged the economy. Eskom is the utility responsible for 95% of the country’s electricity generation. In December 2019, it implemented the widest blackouts to prevent the grid from total collapse. This resulted in the biggest manufacturing contraction in five-and-a-half years and prevented unemployment from posting a contraction in the fourth quarter, for the first time in eleven years. The data sufficed to pressure the GBP/ZAR above its short-term support zone.

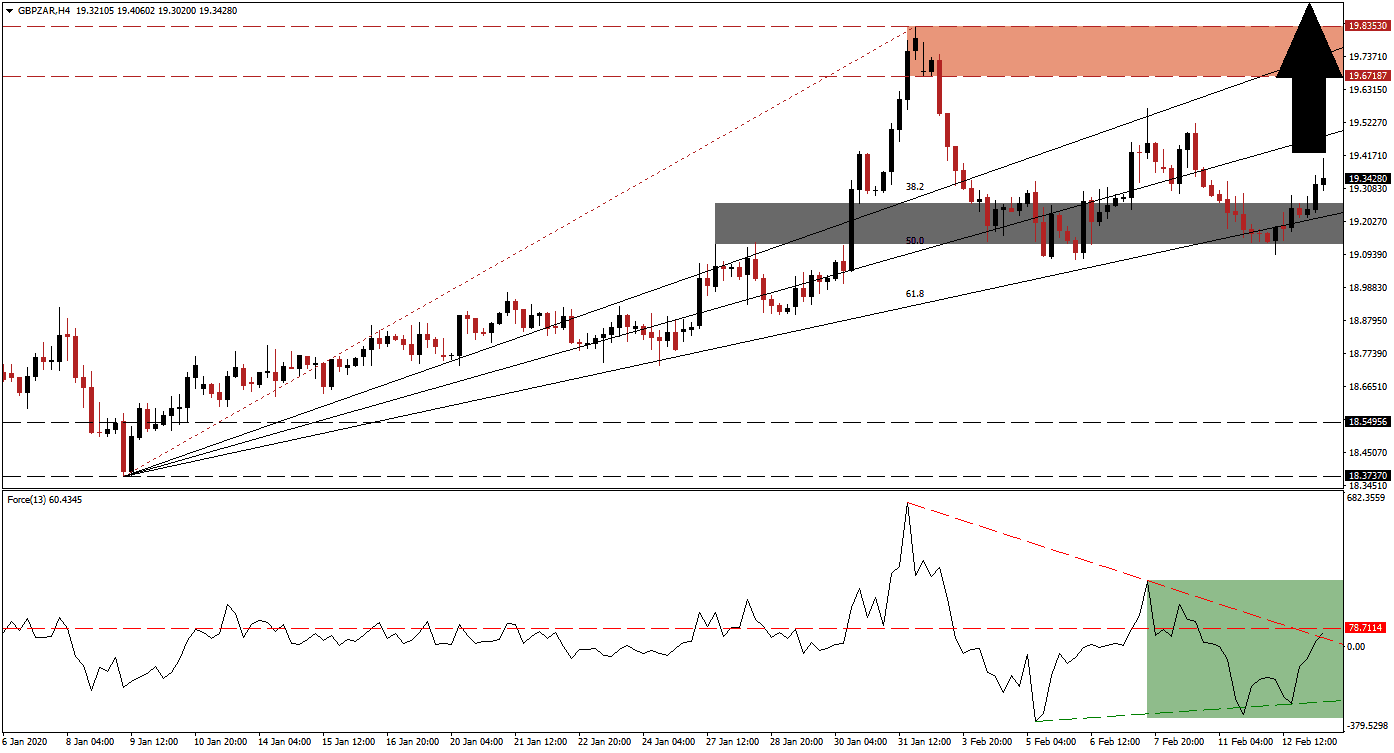

The Force Index, a next-generation technical indicator, temporarily dipped below its ascending support level before initiating a quick recovery. Bullish momentum continues to increase, confirming the breakout in the GBP/ZAR. The Force Index has now pushed above its descending resistance level, as marked by the green rectangle, from where a breakout above its horizontal resistance level is favored to follow. This technical indicator is positioned in positive territory, suggesting bulls are in charge of price action. You can learn more about the Force Index here.

Following the breakout in this currency pair above its short-term support zone located between 19.12610 and 19.26025, as marked by the grey rectangle, more upside is expected to follow. The ascending 61.8 Fibonacci Retracement Fan Support Level supported the breakout in the GBP/ZAR. Conversion of its 50.0 Fibonacci Retracement Fan Resistance Level into support is likely to provide the next wave of net buy orders to the developing advance, allowing the Fibonacci Retracement Fan sequence to act as a guide higher.

While a re-test of the short-term support zone cannot be ruled out, a normal price action pattern after a breakout, the GBP/ZAR is positioned for an extended advance. As the UK is set to start negotiations with the EU on a post-Brexit trade deal, the South African economy will face more disruptions from the Eskom fallout. Business sentiment remains depressed, consumer confidence weak, and the unemployment rate elevated. This currency pair is anticipated to challenge its resistance zone located between 19.67187 and 19.83530, as marked by the red rectangle. A breakout will take it into the 20.00000 psychological resistance level from where mote upside requires a new fundamental catalyst.

GBP/ZAR Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 19.34250

Take Profit @ 20.00000

Stop Loss @ 19.15000

Upside Potential: 6,575 pips

Downside Risk: 1,925 pips

Risk/Reward Ratio: 3.42

A sustained breakdown in the Force Index below its ascending support level is expected to lead the GBP/ZAR into one of its own. Due to the dominant fundamental conditions, supported by short-term technical developments, the downside potential appears limited to its long-term support zone. Price action will face this zone between 18.37370 and 18.54956, and Forex traders are recommended to consider this an excellent buying opportunity.

GBP/ZAR Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 18.95000

Take Profit @ 18.55000

Stop Loss @ 19.15000

Downside Potential: 4,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 2.00