Trade negotiations between the EU and the UK are under new time pressure after the UK government announced that if no progress has been made by June, it may focus its efforts on a WTO governed post-transition period relationship. Many refer to this as a no-deal Brexit but confuse it with chaos. The British Pound enjoyed a surge in bullish momentum with the economy in full recovery mode after Prime Minister Johnson secured an overwhelming majority during December’s snap election. With the long-term bullish trend intact, a minor correction is favored in the GBP/ZAR before a new breakout sequence can emerge.

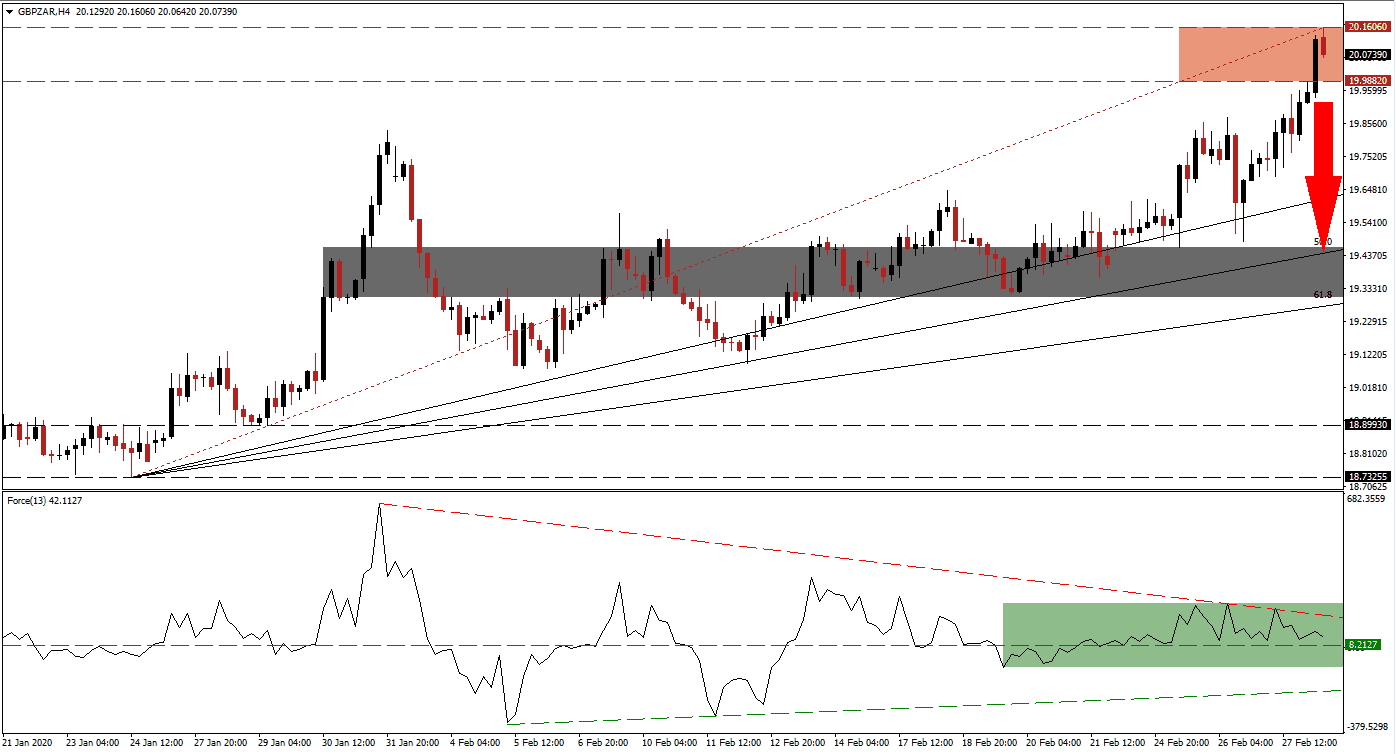

The Force Index, a next-generation technical indicator, shows the lack of bullish momentum to extend the current advance. Its descending resistance level is applying downside pressure, as marked by the green rectangle, expected to result in a breakdown below its horizontal support level. The Force Index is then likely to challenge its ascending support level in negative territory. This technical indicator will cede control of the GBP/ZAR to bears with a crossover below the 0 center-line. You can learn more about the Force Index here.

With bullish momentum fading after this currency pair reached its resistance zone located between 19.98820 and 20.16060, as marked by the red rectangle, a profit-taking sell-off is favored to materialize. It will close the gap between price action and its ascending 38.2 Fibonacci Retracement Fan Support Level. South Africa continues to struggle with the fallout from its energy crisis centered around Eskom, responsible for 95% of electricity generation. Estimates suggest this will limit GDP expansion in 2020 to just 1.0%, offering a fundamental catalyst for the GBP/ZAR to record fresh 2020 highs after a correction.

Forex traders are advised to monitor the intra-day high of 19.83530, a previous peak that led to a more massive sell-off before the Fibonacci Retracement Fan sequence reversed it. More net sell orders are anticipated to follow a breakdown below this level, providing fuel to the pending correction in the GBP/ZAR. The short-term support zone located between 19.30455 and 19.46310, as marked by the grey rectangle, is enforced by its 50.0 Fibonacci Retracement Fan Support Level, which is on the verge of eclipsing it. A breakdown below it will require a new fundamental catalyst.

GBP/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 20.07500

Take Profit @ 19.46250

Stop Loss @ 20.24000

Downside Potential: 6,125 pips

Upside Risk: 1,650 pips

Risk/Reward Ratio: 3.71

A push in the Force Index above its descending resistance level may inspire a breakout in the GBP/ZAR. The long-term outlook remains increasingly bullish, but a short-term correction will ensure the longevity of it. Failure to interrupt the current advance now is likely to position this currency pair for a more massive correction at a later stage in the cycle. The next resistance zone awaits price action between 21.20060 and 21.50450.

GBP/ZAR Technical Trading Set-Up - Breakout Scenario

Long Entry @ 20.52000

Take Profit @ 21.28000

Stop Loss @ 20.24000

Upside Potential: 7,600 pips

Downside Risk: 2,800 pips

Risk/Reward Ratio: 2.71