We may witness a strong fluctuation in the performance of the GBP/USD during trading session on Tuesday, as the Pound awaits the announcement of a package of important British economic data and the dollar is awaiting a reaction from the statements of Federal Reserve Governor Jerome Powell in his important testimony today. Ahead of that important data and events, the pair is settling under a downward pressure that pushed it towards the 1.2871 support, the lowest level in more than two months, before settling around 1.2917 at the time of writing. What has contributed to the pressure on the pound is concern about the failure of trade talks between the European Union and Britain.

There are growing signs that upcoming trade negotiations between the European Union and the United Kingdom will be risky. The reports issued at the end of last week indicated that the trade negotiations between the European Union and the United Kingdom may collapse "within months", and these headlines are supposed to feed the markets' concerns and ultimately guarantee that the British pound will remain bearish in the coming days. It is said that the European Union is tightening its demands for unchanged access to fishing waters in the United Kingdom after Britain's exit from the European Union, which the United Kingdom strongly opposes.

The British pound started 2020 in a strong manner, but lost its strength in February as the currency markets shifted focus from the economy and the Bank of England's policy towards Britain's exit from the European Union. According to a report published in the Telegraph newspaper at the end of the week, European countries are tightening their demands for access to fishing waters in the United Kingdom to remain unchanged after Britain leaves the European Union. In return, the UK pledged to regain control of its water after the Brexit, which would allow it to limit the amount of fish that the European Union countries could extract. The large territorial waters in the United Kingdom depend heavily on the Spanish, French, Dutch, Belgian and Irish fishing fleets, and it is known that these countries see significant negative impacts if the United Kingdom reduces their access to their waters.

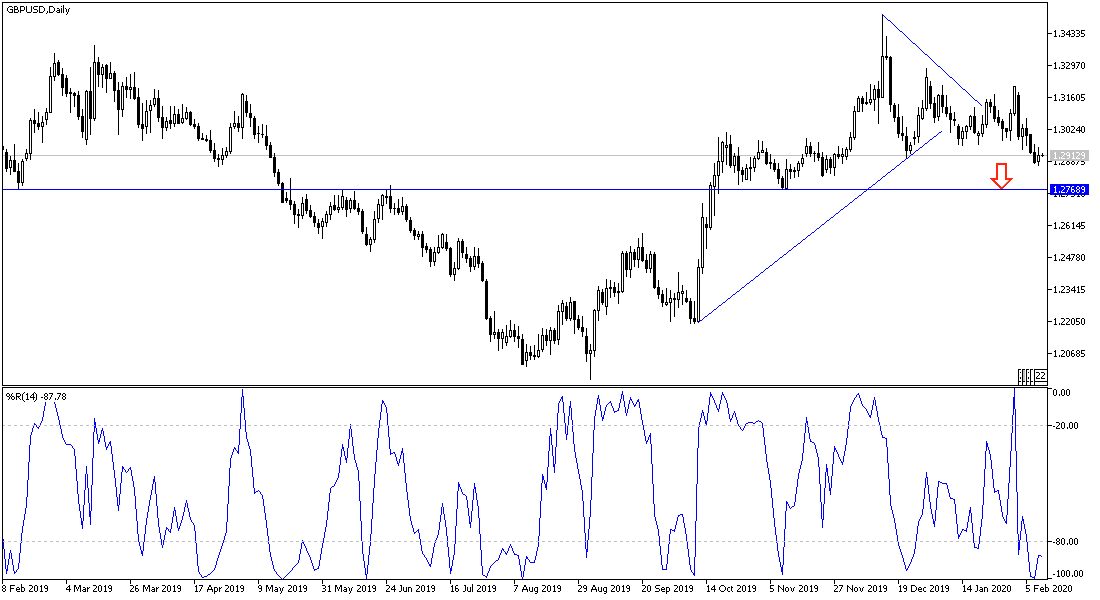

According to the technical analysis of the pair: According to the performance on the daily chart, the GBP/USD is under downward pressure as long as it is stable below the 1.3000 psychological support and the pair is prepared for more downward pressure unless a surprise comes from the results of the British economic data today, or a breakthrough in negotiations between the European Union and Britain on the contentious issues between them. And there will be no reversal of the current downtrend without the pair moving towards the 1.3300 resistance. The stability of the downward performance make the support levels at 1.2870, 1.2800 and 1.2735 the next bear targets.

As for the economic calendar data: From Britain, the GDP growth rate, the industrial and manufacturing production index, and trade balance of goods will be announced. From the United States, all attention will be on the content of Jerome Powell's testimony.