Since the beginning of this week’s trading, the GBP/USD pair is going under downward pressure pushing it towards the 1.2940 support, with renewed fears of difficult talks between Britain and the European Union about the future of trade relations between them in the post-Brexit phase, which happened officially last Friday, making The United Kingdom the first country to exit from the bloc, making the number of members 27.

The feature of their dispute between the two is that Britain wants an agreement that grants it access to the single market, and at the same time, be open to trade agreements with all countries around the world, and the transitional period does not exceed the year 2020, and in return, the European Union wants the United Kingdom to abide by the rules of the European Union to reach the single market and benefit from 450 million people, and to extend the transitional period to 2022.

The pound ignored the recent positive British economic data and focused more on the path of negotiations between the two sides of the Brexit, which was characterized by a sharp start. The British pound falls came amid the headlines at the weekend that Prime Minister Boris Johnson aspires to an Australian-style deal if he is unable to secure a free trade deal like that between Canada and the European Union, which ensures that up to 98 percent of goods traded Not subject to tariffs.

The US dollar is still reaping gains by investors flooding to it as a safe haven, amid global fears of the spread of the Corona virus, which threatens global economic growth. This is in addition to the positive results of the American economic data and the anticipation for the US job numbers, which will be announced tomorrow in an official report that is closely monitored by economists and investors alike. The superior performance of the US economy has maintained a steady increase in the value of the dollar since the early second quarter of 2018, despite the fact that the price of the Euro against the dollar has been largely traded between 1.10 and 1.12 levels since October.

Economists believe that the British economy is likely to have shifted at the end of 2019 and that the possibility of increased government spending, which is likely to be announced in the March budget, should provide a "dynamic of fiscal and economic policy".

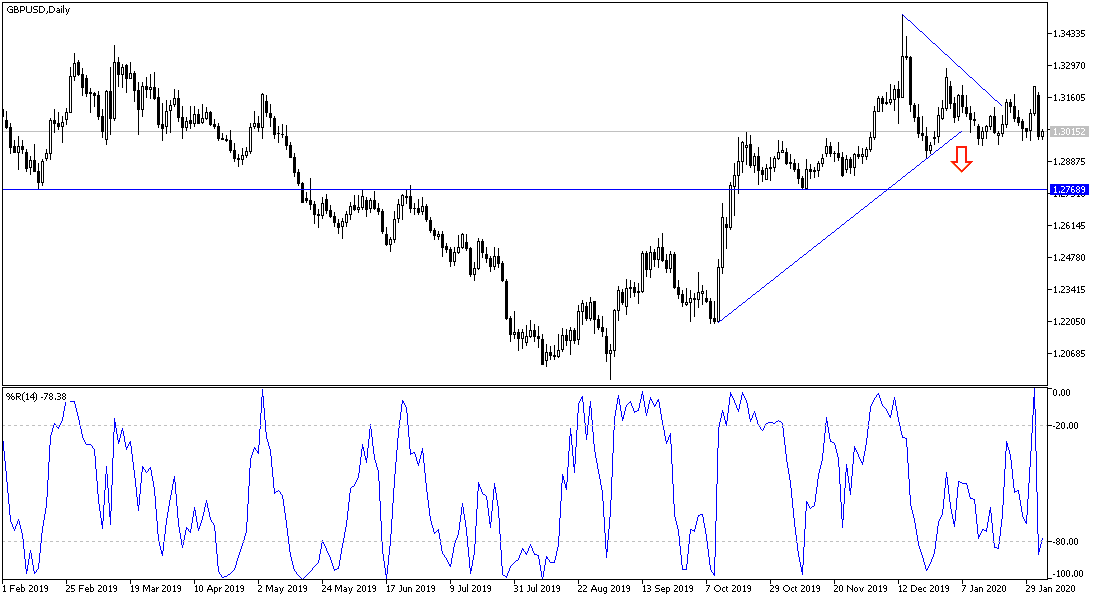

According to the technical analysis of the pair: the recent downward pressure pushed the GBP/USD pair to break the 1.300 psychological support, which supports the bear's control over performance, and this performance is expected to continue to move the pair towards stronger support levels, the closest of which are 1.2940 and 1.2880, respectively. Fears of difficult negotiations between the bloc and Britain will continue to be a factor leading to the continued volatility of the pound in the coming months, therefore it is better to sell the pair from each upside level, and the nearest current resistance levels are 1.3085, 1.3145 and 1.3220, respectively.

As for the economic calendar data: the US data will be focused on the claims of the unemployed, the rate of non-agricultural productivity and unit labor costs.