Last Friday’s session, on the 31 January 2020, was the official date for Brexit. The pound got some gains against most of the other major currencies, as international markets waited 4 years for this date. The share of the GBP/USD rebound was to rise to the 1.3208 resistance, its highest level in nearly a month, and is stable around 1.3160 at the time of writing. As we mentioned before, we now confirm that the gains of the British Pound may soon evaporate during the months of the transitional period, during which there will be negotiations between the two sides of Brexit on the future of trade relations between them, knowing that dispute is a feature of negotiations between them.

The British pound rose more than 1% against the dollar last week after the Bank of England's decision to leave the interest rate at 0.75% last Thursday, contrary to market expectations of the possibility of lowering interest rates. Technical studies point to the appreciation of the British pound, but these signals can easily be ignored due to the rapid spread of Corona virus inside China and in other countries, which is the most influential and most important event on the part of global financial markets. Due to economic concerns over its consequences for the performance of the second largest economy in the world, the People's Bank of China (PBOC) announced that it will pump 1.2 trillion Yuan (130 billion pounds) of cash into the financial system through reverse repurchases in an attempt to alleviate any “liquidity” or shortage In cash.

And because of Corona, some Chinese cities turned into ghost cities during the past week, and with the virus now present in all provinces of China, there is an opportunity waiting for the whole country for a period of quarantine or self-isolation. This will have important and unprecedented consequences for the Chinese economy, which relies on manufacturing and export.

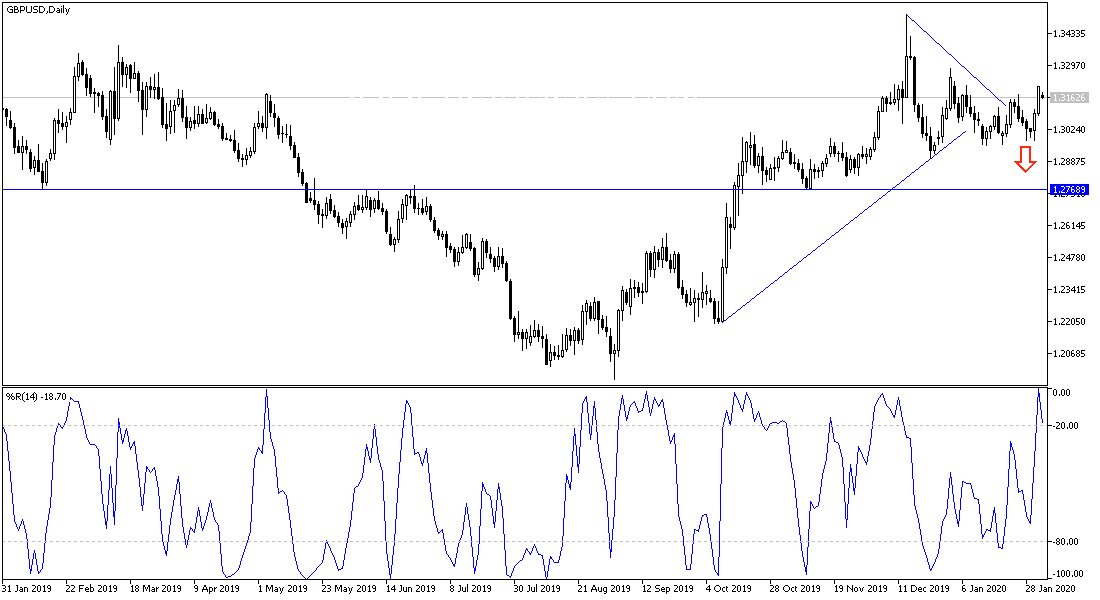

According to the technical analysis of the pair: On the GBP/USD daily chart, there is a clear break of the bearish channel, but we are awaiting a confirmation of the reversal strength, which may happen if the pair rises to the 1.3300 resistance. I still prefer to sell the pair from every upside level. It may return to the path of its descending channel if the pair falls to the support levels at 1.3090 and 1.0995, respectively. Trade relations negotiations between the two sides of Brexit in the coming months will be a good reason to press the gains of the pound against the other major currencies.

As for the economic calendar data: From the UK, the Industrial PMI will be announced, and from the United States, the ISM Manufacturing PMI will be announced.