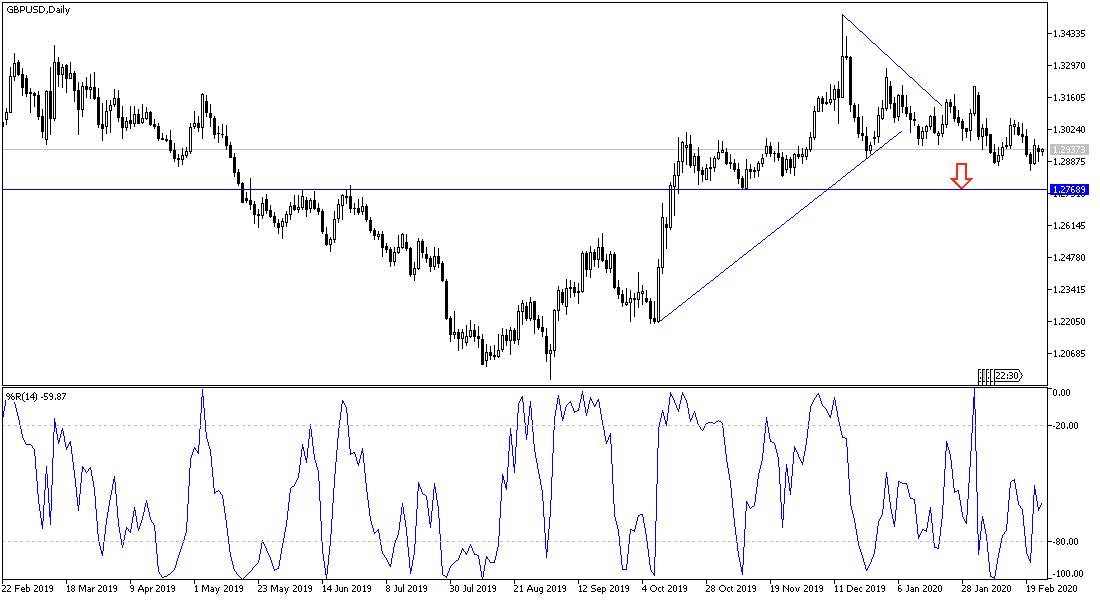

In the beginning of this week’s trading, the GBP/USD pair dropped again, reaching the 1.2886 support, after attempting to rebound higher at the end of last week’s trading, with gains that extended to the 1.2980 resistance. What contributed to the decline was the resurgence of strong demand by investors for the US dollar as a safe haven amid the rapidly increasing cases of the Coronavirus virus outside Chinese boarders, to money countries around the world, reaching the Middle East and the E.U, as well as increasing numbers in China itself. Japan and South Korea were the most prominent in the disease outbreak. The epidemic has become a real and powerful threat to the future of global economic growth.

Currency traders are watching the British pound against the other major currencies over the coming days and weeks as markets prepare for the March 11 budget announcement, which should carry news of a significant increase in government spending. According to recent reports, Chancellor Richie Snack may loosen the UK's financial rules to allow the government to spend more than what the market expects now.

The Telegraph says the government may seek to raise an additional 26 billion pounds a year via borrowing when the budget is announced next month. The chancellor is said to be considering allowing the government the ability to exceed 1% or less of the current balanced budget - a move that could raise an additional 26 billion pounds of spending. Another option, which would save an additional 11 billion pounds, is to ease financial rules to allow the government to achieve a balanced budget within five years instead of three years.

The British government has set for itself a set of rules related to spending, borrowing, and taxes that will ensure that its books are balanced within a specific time period, but the policy of this responsibility does not appear attractive to the new Boris Johnson government, which aims to increase spending on health, schools, and transportation. Therefore, the increase in financial spending is expected to support the economic growth in the UK, which in turn supports sterling against the other major currencies, and some analysts believe that it will be one of the reasons to expect a more stable currency in the first half of 2020.

According to the technical analysis of the pair: The 1.3000 psychological resistance is still the key to the reversal of the general trend of the GBP/USD pair, which is still under downward pressure in the long run. 1.2800 Psychological support remains a targets for the bears to control performance again and to strongly push the pair into deeper support areas. This will happen if demand for the dollar increases as a safe haven from the consequences of the Coronavirus, and if pessimistic statements were issued by the two parties of the post-Brexit negotiations, the European Union and Britain.

Regarding the economic calendar data: There are no significant UK economic releases today. From the United States, consumer confidence index and Richmond industrial index data will be released.