The gains of the US dollar stopped, giving the GBP/USD price only the opportunity to correct towards the 1.2980 level during last Friday's trading session, and its recent gains were capped around the 1.2848 support, the lowest level in more than three months, and was stable around the 1.2941 level in the beginning of this week’s trading. The cable is still suffering from weak investor confidence due to the expected negotiations between the European Union and Britain after a few days, which are characterized by sharpness before its commence, which confirms that its path will be troublesome for the British pound in the foreign exchange market. The cable ignored the positive economic releases from Britain last week. Difficult negotiations mean more losses to the British Pound.

Official data last week revealed that British retail sales rose 0.9% in January, while data before that from the Office of National Statistics showed that inflation is bridging the gap between the CPI and the Bank of England goal of 2%. The results of that data, along with good PMI releases, could allow the Bank of England to leave the benchmark interest rate unchanged throughout 2020, contrary to market expectations, which will support the pound against many currencies. As for the British labor market, the number of claimants in the United Kingdom for January exceeded expectations by 22 thousand with 5500. However, the 3-month average earnings for the period ending in December failed to meet expectations. This figure grew by 2.9% and 3.2% (including and excluding bonuses) missing expectations by 3.0% and 3.3%, respectively.

The US dollar remains the strongest with a stable economic performance and the stability of monetary policy of the Federal Reserve Bank. This is in addition to investing in it as a safe haven since the beginning of the Corona epidemic, which paralyzed the economic performance of the second largest economy in the world.

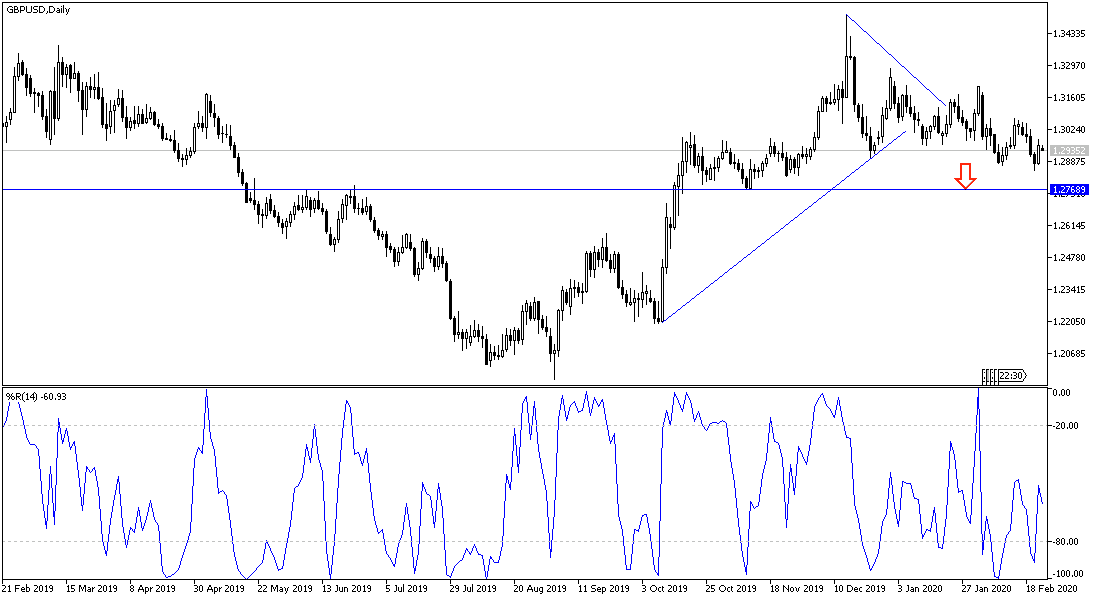

According to the technical analysis of the pair: In the short term, it appears that the price of the GBP/USD pair started a bullish correction after Friday's recovery, breaking RSI overbought levels. However, it faces a strong moving average resistance from the 100 hour moving average. Therefore, bulls will target short-term profits at 1.3000 or higher at 1.3050. On the other hand, bears will target lower profits at around 1.2895 or less at 1.2851 this week.

On the long run, and depending on the daily chart, it appears that the GBP/USD has ended a major reversal in market sentiment. The pair reached a low of 1.1953 in September last year and since then it has risen to 1.3517. It appears that it faces strong resistance around 1.3250, which could lead to the next reversal. Thus, bears will target the pair's decline to 1.2757 support or lower at 1.2473. On the other hand, bulls are hoping to maintain bullish control by targeting profits at 1.3217 resistance or higher at 1.3520. I still prefer to sell the pair at every upside level.

The pair is not looking for any important economic data today, whether from the U.K or the United States of America.