Despite the positive British job numbers, the benefit for the GBP/USD pair was limited, as the pair only rose to the 1.3048 level before falling back to the 1.2995 level, with the continued strength of the US dollar. The cable began to gradually give up the recent optimism after the dismissal of the British Treasury Secretary, and amid expectations that more spending will be available to the Conservative government to revive the UK economy, which was strongly affected by the uncertainty about the future of Brexit over the years.

According to the Office for National Statistics, the UK added a total of 180,000 to its workforce in the three months to December 2019, more than the 145,000 increase that forecasts had expected. However, this remains below the 208K level in November, and employment usually tends to slowdown in the Christmas period. Meanwhile, the number of claims for the unemployed increased by 5.5 thousand, well below the 22.5 thousand that the markets had expected.

The strong result was largely due to a 203,000 increase in full-time work, which was partly compensated for by a decrease in the number of part-time workers by 23,000. The country's unemployment rate remained steady at 3.8%. The results of the report were negative in the wages component. Average wages, including bonuses, increased by 2.9% in December, which is less than the 3.0% markets had expected, and much lower than the November growth of 3.2%. Average wages, without bonuses, increased by 3.2%, which was below expectations at 3.3% and the November reading at 3.4%.

This data covers the December period and therefore does not fully represent any increase in economic activity after the general elections. We expect the March business report, which covers January, to have more impact on the markets. However, the general idea of the report suggests that the UK labor market remained relatively strong in a period of severe political uncertainty, and thus provides a good starting point for further improvements in wages and employment in the first half of 2020.

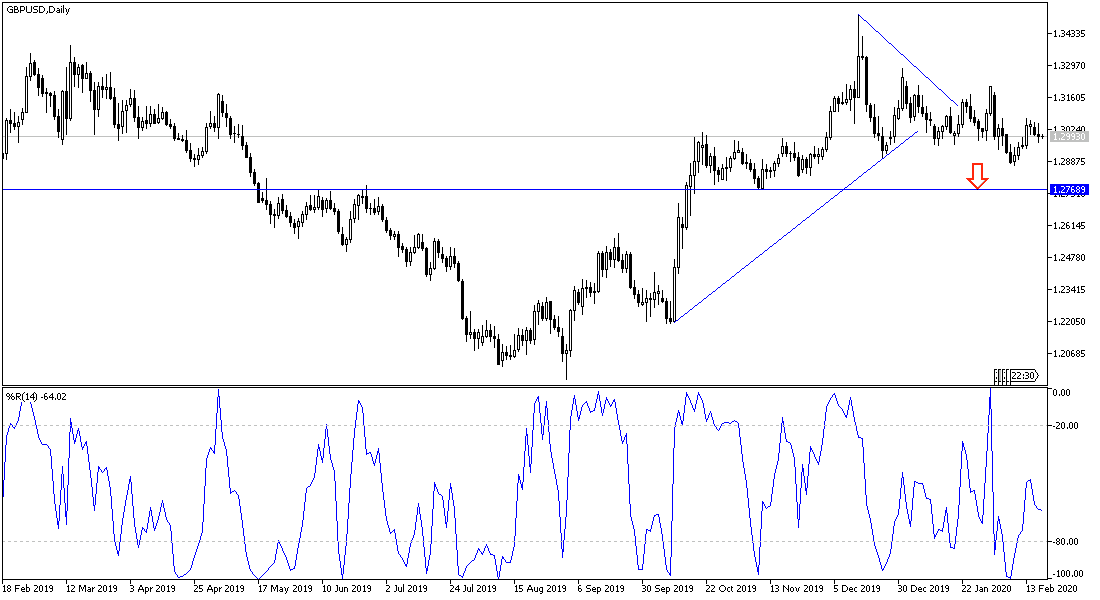

According to the technical analysis of the pair: The return of GBP/USD stability below 1.3000 will support the return of the bear's control over the performance, especially with the continued US dollar strength. Therefore, the support levels 1.2945 and 1.2880 might be the next bears’ targets, and thus the return in the bearish path, as shown on the daily chart below. A successful rebound to the 1.3075 and 1.3145 resistance levels might give the pair an opportunity to correct the upside and reverse the trend. But at the same time I still prefer selling the pair from every upper level. The negotiations between the European Union and Britain do not herald a quick positive vibe and the clash between them may increase with each side sticking to what they deem best for its future.

For the economic calendar data: Within the Super Sterling Week, the second round of important data will be announced, including British inflation figures; consumer price index and producer price index. During the American session, the producer price index and building permits will be announced, and the minutes of the last meeting for the Federal Reserve.