Prior to the announcement of the details of job and wages reports in Britain, the price of the GBP/USD pair retreated to the 1.2991 level at the time of writing, after recording stronger gains reaching the 1.3070 resistance after the recent optimism due to the resignation of the British Treasury Minister in a move through which the British government is seeking to boost spending to revive the UK economy. Forex traders will focus on the path of negotiations between the two sides of Brexit, the European Union and Britain. The UK, according to its officials, does not want a unique or special deal, but only requests a copy of the deals that the European Union has already concluded, as is the case with Canada and South Korea. A spokesman for the British Prime Minister's office told The Times that the United Kingdom "does not ask for anything special, detailed or unique", and the United Kingdom will demand "a deal like the one that the European Union previously concluded with other friendly countries such as Canada."

These countries actually have duty-free trade with the European Union but it is not necessary for them to follow the rules of the European Union. The British government tends that any deal cannot include any regulatory alignment, or any jurisdiction of the European Union’s Court of Justice over the laws of the United Kingdom, or any control that transcends national borders in any area. It is believed that the European Union wants the UK to commit to aligning subsidies, complying with its tax standards and adhering to its labor and environmental rules in order to ensure that the UK does not turn into a competitor.

The major disagreement between the two sides, before the formal start of trade negotiations, will keep foreign exchange markets wary of the failure of both sides to settle an agreement by the end of 2020. This means a collapse in the exchange rate of the British pound, followed by the that of the Euro.

According to press reports, Jean-Yves Le Drian, the French foreign minister, said it was possible that the negotiators would break apart, with the expectation that the two sides would fight hard over fishing rights. Le Drian said at a security conference in Munich: “I think that with regard to trade issues or about measures for our future relationship that we will discuss, we will start, we will tear each other apart. But this is part of the negotiations. Everyone will defend their interests”. France is seen as the most "toughening" European Union country when it comes to their position ahead of trade negotiations, especially as the country fears its fishermen will lose access to UK water.

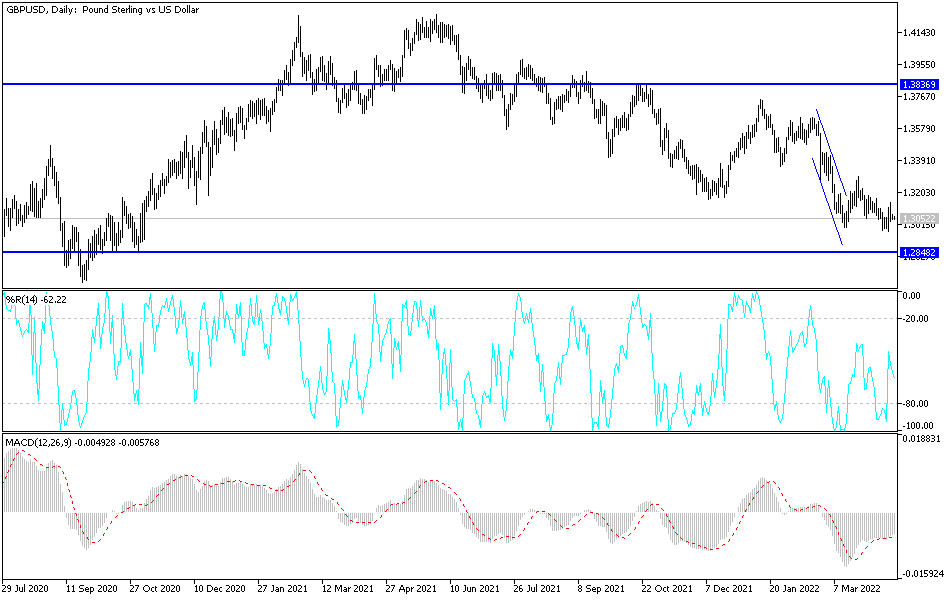

According to the technical analysis of the pair: The GBP/USD price path is in the beginning of an upward correction phase, but it still needs stronger catalysts to confirm the trend reversal, which will not happen without moving towards the 1.3300 resistance. On the downside, stability below the 1.3000 support will support the bear's control, as is the case in the long run. The pair is still facing sell-offs with every upward rebound, as trade negotiations between the two sides of Brexit will not be easy.

As for today's economic calendar data: All focus will be on the details of the British jobs report, which contains the announcement of job change rate, unemployment rate and average wages. From the United States of America, only the Empire State Industrial Index will be announced.