The British Pound made a surprising rise to Forex traders during last week's trading and the share of the GBP/USD pair was a strong rebound, pushing it towards the 1.3070 resistance, before closing the week's trading around the 1.3047 level. Gains were supported by the appointment of Conservative MP Rishi Snack as the new chancellor of the United Kingdom after the reshuffle of Prime Minister Boris Johnson led to the sudden resignation of Sajid Javed, the country's Treasury secretary. Optimism prevailed in the market amid expectations of more government spending to revive Britain's economy.

“We were already expecting fiscal policy to provide a good boost for economic growth,” says Paul Dalles, the UK's chief economist at Capital Economics. This increases the potential for GDP growth, market interest rate expectations and greater returns for the British Pound.

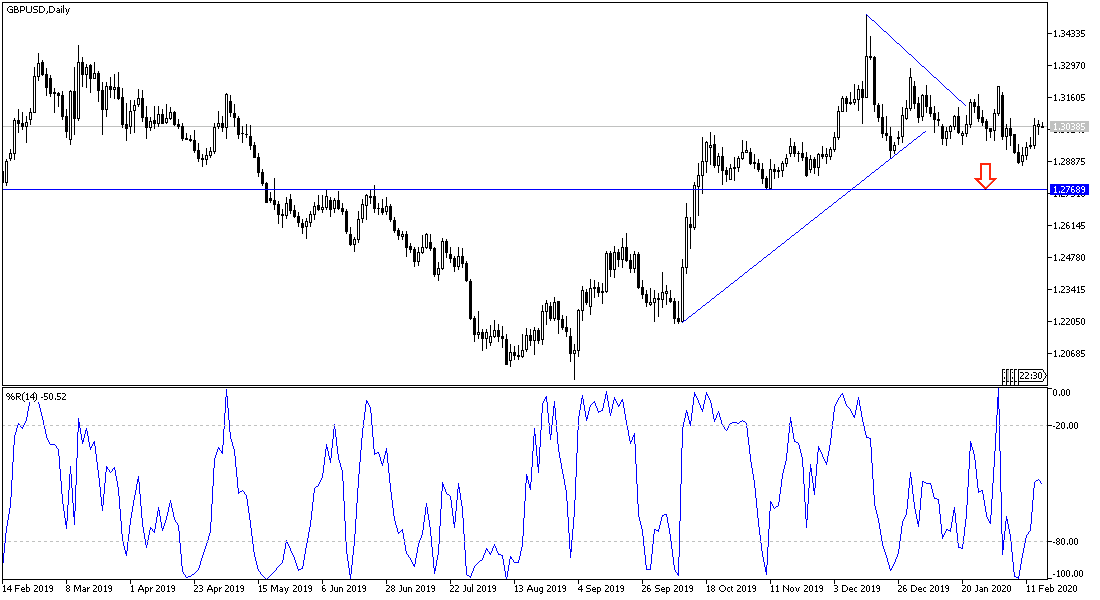

The British economy stopped in the last quarter of 2019, forcing the Bank of England to consider cutting interest rates aggressively before the policy decision last month, due to the local and international headwinds which pushed the GBP/USD to collapse to the 1.2871 support in the first trading week this February.

Why do we prefer selling trading strategy for the pair from each upside level?

Optimism about the new British Treasury Secretary may evaporate quickly as investors' attention turns toward the path of intense negotiations between Britain and the European Union in the transitional period throughout 2020. The beginning is not reassuring, as this is the last chance for the two sides to reap the greatest gains from the Brexit deal. Severe negotiation may lead to the collapse of the talks at an early date that was recently estimated to be the end of April 2020. On the other hand, the US economy is still stronger, with the support of the US Federal Reserve sticking to its monetary policy. And the US dollar is still reaping gains as a safe haven, as fears persist over the spread of the Corona epidemic and its threat to global economic growth.

According to the technical analysis of the pair: Despite the recent bounce, the GBP/USD is still in a strong bearish track and there will be no true reversal of the trend without the price moving through the 1.3300 resistance. Returning below the 1.3000 psychological support will support the bears' readiness to take possession again, and thus move the pair to 1.2970 and 1.2880 levels again. I still prefer to sell the pair from every bullish bounce.

Expect quiet moves in the path of the pair in light of the American holiday and the economic calendar has no important British economic data today.