The price of the GBP/USD pair showed remarkable resistance during yesterday's trading session in light of the continued strength of the US dollar, and rose to the 1.2001 resistance before settling around 1.2950 at the time of writing. However, this steadfastness may not be long, as the British pound is still facing a difficult year amid sharp negotiations between the European Union and Britain, which does not herald smooth relations in the future, and fears increased that the talks could collapse quickly if each party sticks to what they wants. The British pound has recovered from its strong losses against the dollar and the Euro this week after a volatile start for 2020, and although negotiations on the future trade relationship with the European Union are scheduled to start from March 03, it is expected that the path for the British currency will be bumpy.

The two sides outlined their opening positions for the talks earlier in February, when Prime Minister Boris Johnson was grateful for the benefits of organizational and legislative independence, or at least the relations be such as the European Union’s deal with Canada or Australia, to avoid a no deal Brexit. The end of June marks a deadline by the European Council for Boris Johnson to request an extension of the "transitional period" entered by the United Kingdom after Britain formally exit the European Union on January 31, 2020.

On the economic level. The results of economic data from Britain recently were not promising. Capital Economics expects the British economy to grow fast enough for the Bank of England to avoid a rate cut this year, which is expected to raise the British pound at the end of the year in part because investors have already bet that the Bank of England will cut the rates to 0.50% in 2020.

On the other hand, the US economic performance continues to impress the Fed's policymakers. For two days in a row, Bank Governor Jerome Powell gave his important testimony to committees of the Congress and the Senate and emphasized the strength of the American economy and that the bank's monetary policy is well suited to the performance, the bank monitors the outbreak of the Corona virus and its impact on the US economy and the global economy, and that so far its impact remains negligible, and that the bank is ready to intervene if things go wrong and that there is no need for Trump administration to interfere with the bank's policy.

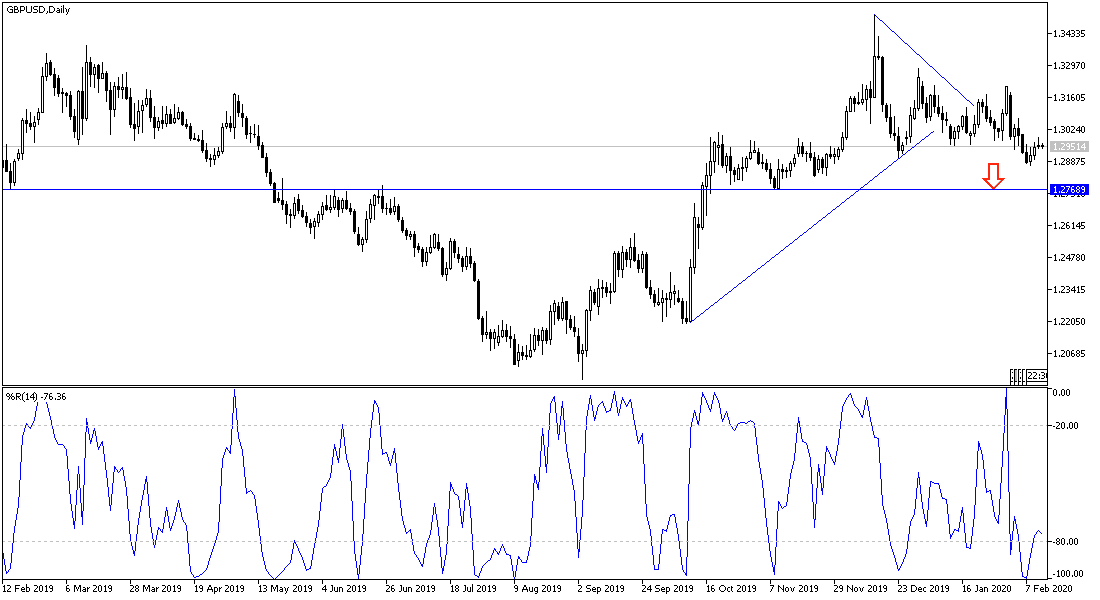

According to the technical analysis of the pair: The price of GBP/USD is still in a downtrend as long as it remains stable below the 1.300 psychological support. The sell-off on the pair will not stop and is awaiting a rebound higher at any time to return to selling it, as 2020 will be very difficult for any gains achieved by the pound. The closest resistance levels currently are 1.3020, 1.3100 and 1.3175. The US inflation figures today and tomorrow will have a strong affect to the performance of the US dollar, especially as markets absorb the reaction from Jerome Powell's testimony.

For today's economic calendar data: All focus will be on the US Consumer Price Index and jobless claims.