We noticed an upward bounce in the price of the GBP/USD pair to the 1.2967 resistance, due to a rebound from the 1.2871 support, and despite the rebound, the pair will not succeed in reversing the downtrend, which still strongly controls the performance, as long as it is stable below the 1.3000 psychological support. Yesterday's gains ignored the announcement of slowing economic growth in Britain and focused more on the testimony of the Federal Reserve Governor Jerome Powell, who sees risks to the US and global economy from the continued outbreak of the Coronavirus.

The British economy slowed in the fourth quarter of 2019, as uncertainty about Brexit and the general elections affected investments and spending, according to the estimates of the National Bureau of Statistics yesterday. The GDP remained unchanged from the previous three months, as expected, after a revised 0.5 percent growth in the third quarter.

Commenting on the results, Rob Kent Kent Smith, a Bureau of Statistics official, told Reuters: "There was no growth in the last quarter of 2019, as the increase in the services and construction sectors was offset by a very weak performance from the manufacturing sector, especially the automotive industry." Kent Smith pointed out that the basic trade deficit widened, as exports of services decreased, and partly offset by a decrease in commodity imports.

On an annual basis, economic growth slowed slightly to 1.1 percent from 1.2 percent in the previous quarter. In the fourth quarter, the dominant services sector witnessed 0.1 percent growth, the weakest quarterly growth since the second quarter of 2016.

And on the American side. Jerome Powell, governor of the United States Federal Reserve, testified before the Congressional Committee, during which he confirmed his confidence in the U.S economic performance, citing continued economic growth and the unemployment rate in the country reaching its lowest level in 50 years. During his testimony, US President Trump tweeted, protesting, "The Fed's interest rate is too high," adding, "The dollar is strong, negatively affecting exports." In a tweet, the president also complained that the Dow Jones industrial average retreated during the Powell testimony, although the Dow Jones recovered later. When Powell was asked during the hearing about Trump's tweets, he replied his usual response that he and other Fed officials were only interested in their mandate to serve the economy and were not thinking of external criticism - from the president or anyone else - in policy-making.

"My colleagues and I focus entirely on using our tools to support ... our goals, and that is all we focus on," he said.

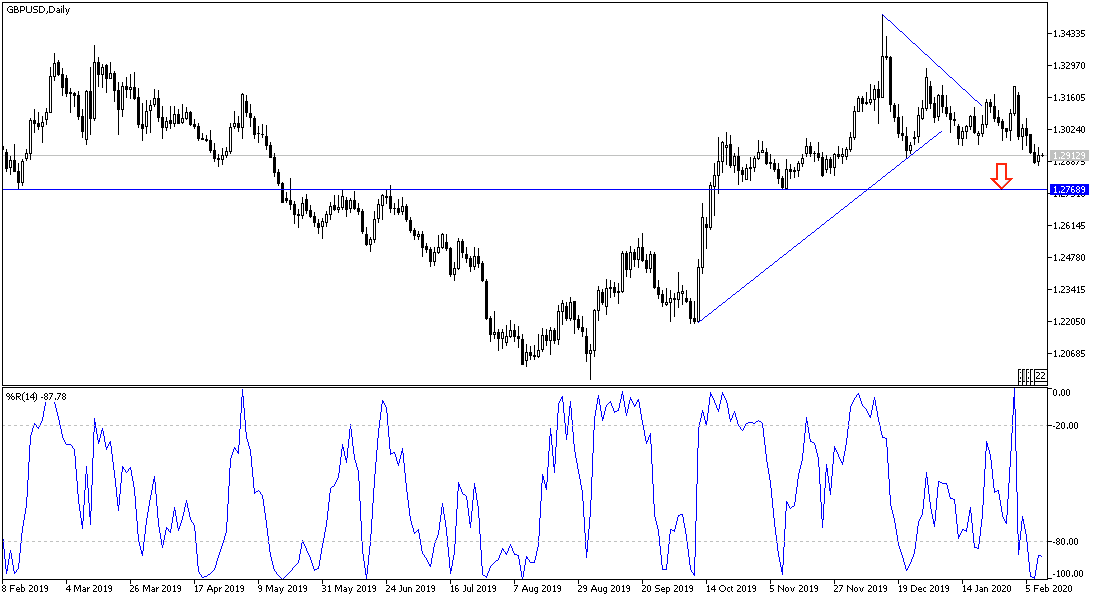

According to the technical analysis of the pair: The GBP/USD pair is still moving inside the scope of a stronger descending channel with the support of stability below the 1.3000 psychological. On the daily chart, we didn’t notice a rebound strong enough to cause a trend reversal. Bears are still in control of performance, despite technical indicators overall reaching overbought areas. Pessimism about the transition period negotiations between Britain and the European Union will threaten any gains the pound makes against other major currencies. Currency traders are waiting for more gains for the pair to return with new sales. The closest resistance levels for the pair are currently 1.320 and 1.3100, respectively. As I mentioned earlier, I now confirm that there will be no correction of the situation without the pair breaching the 1.3300 resistance.

As for the economic calendar data today: There are no significant economic releases from Britain today. From the United States, we will be with the second day of the testimony of Federal Reserve Governor Jerome Powell, and he is not expected to present anything new, but will confirm what he mentioned in yesterday's testimony.