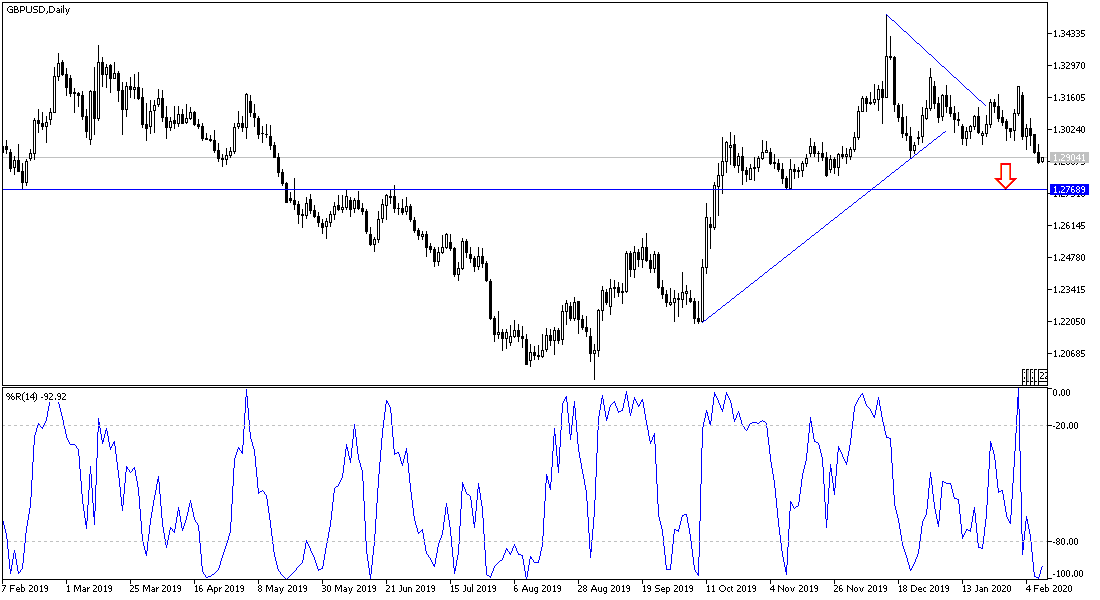

The positive results of the US economic data, and the rising fears of an unknown future for Brexit by the end of 2020 were, all factors that were sufficient to push the GBP/USD pair to move strongly bearish to the 1.2880 support, its lowest level in more than two months. Referring to our technical analyzes for a long time, the strength of the downtrend for the pair will be confirmed in the event that it stabilizes below the 1.3000 psychological support. The sharp start of negotiations between the two sides of the Brexit - the European Union and Britain - to determine trade relations between them post-Brexit phase, was enough to give the pound its strong gains on the day of the Brexit on 31 January 2019, in which the pair rose to the 1.3208 resistance before quickly collapsing to the current support areas.

On the other hand, employment jumped in the United States of America last month, and many people were encouraged to search for work, which indicates that the US economy is still strong despite the threats resulting from the outbreak of coronavirus in China, the ongoing trade war and Boeing's problems.

The strong job growth gives U.S. President Donald Trump more evidence of his assertion that the US economy is thriving under his leadership. This could also complicate the argument that his presidential democratic opponents claim, that the economy does not benefit ordinary Americans. The Labor Department said last Friday that employers added 225,000 jobs in January. Meanwhile, half a million Americans, feeling better about their jobs, have poured into the job market. But those who were not newly counted as unemployed, and their number raised the unemployment rate to 3.6% from the lowest level in half a century in December when it was 3.5%.

The focus will be constantly on the outcome of the rounds of negotiations between Britain and the European Union on their relations after 2020. Each party is fixed on what they deem best for them, and without making any concessions, it will increase the volatility of the pound's performance significantly against the other major currencies.

According to the technical analysis of the pair: the general trend of the GBP/USD pair will remain within a descending channel as long as it remains stable below the 1.3000 psychological support and has reached all the support areas that we expected in the recent technical analyzes. And the continuation of more losses will support the move towards stronger support areas, the closest of which are currently 1.2845 and 1.2780, though I prefer buying from the current decline level or just below it and take advantage of the rebound for the correction, as the pair reached strong oversold areas. The nearest resistance levels currently are 1.2920, 1.3000, and 1.3085 respectively. Today's economic calendar has no important and influential data, whether from Britain or the United States of America.