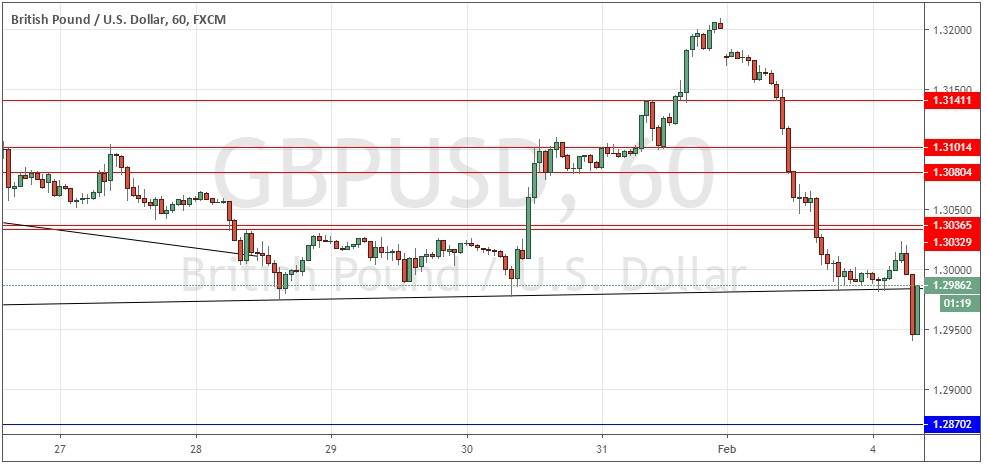

GBP/USD: Supportive trend line broken

Yesterday’s signals were not triggered, as there was no bullish price action at any of the support levels which were reached.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today.

Long Trade Ideas

Long entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3141, 1.3101, or 1.3080.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3033, 1.3037, or 1.3080.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that the highest support level at 1.3141 looked pivotal. I was looking for the price to rise from there and was completely wrong about that but seeing the level as pivotal was a great call as the price fell from there during the day by as much as approximately 140 pips.

The Pound has fallen strongly as the British government signals a harder Brexit on trade terms that could be something of a return to the old Commonwealth model.

The bearish break earlier below the long-term ascending trend line is a bearish sign, although the price has bounced back quickly. The key test now technically will be whether the resistance levels above the big round number at 1.3000 hold if and when they are retested. Despite the bullish recovery, I would be very happy to take short trades from rejections at any nearby resistance level. There is nothing of high importance due today regarding either the GBP or the USD.

There is nothing of high importance due today regarding either the GBP or the USD.