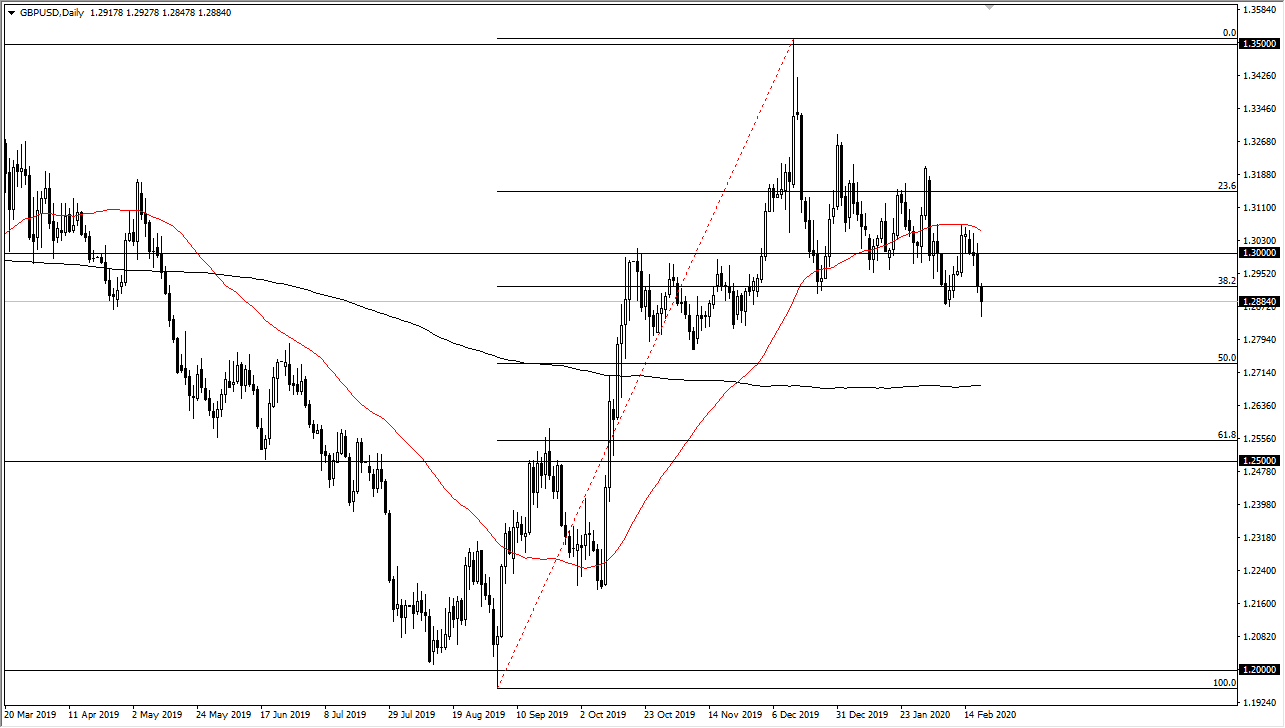

The British pound has initially fallen during the trading session on Thursday but did bounced just a bit to get back some of the losses. At this point, it looks as if the market is testing an area that sees a lot of support in it, perhaps thought of as the 1.2850 level. The market ended up forming a candlestick that is somewhat like a hammer, and as a result perhaps the British pound has gotten a bit oversold in the short term and we could go looking towards a bit of a bounce. Ultimately, the market continues to pay attention to the negotiations between the United Kingdom and the European Union, and that of course continues to be a bit of a thorn in the side of the British pound itself.

Having said that, the British economy has been doing better than anticipated, so the British pound should continue to be somewhat buoyant. Quite frankly, the biggest problem with the British pound in this pair is the fact that it’s going up against the US dollar. With that in mind, if you are looking to buy the British pound or if this market starts to rally, you may be looking to actually buy the British pound against other currencies that are even weaker, along the lines of the Australian dollar or maybe New Zealand dollar.

I do think that we are getting close to some type of turnaround but can’t call it quite yet. If we were to turn around a break above the red 50 day EMA, that would be a very bullish sign. Otherwise, if we break down below the bottom of the candlestick for the trading session on Friday, then I think we go looking towards the black 200 day EMA for support. I believe at this point in time the British pound is trying to form some type of base, but you probably have quite a bit of time to get involved and start buying. I wouldn’t necessarily be a huge rush, because the British pound is trying to change its overall trend, something that takes forever sometimes as there are huge amounts of orders that need to be facilitated in order to make that happen. I will be paying attention to the way the Friday candlestick closes in order to place a trade if it presents itself in this general vicinity.