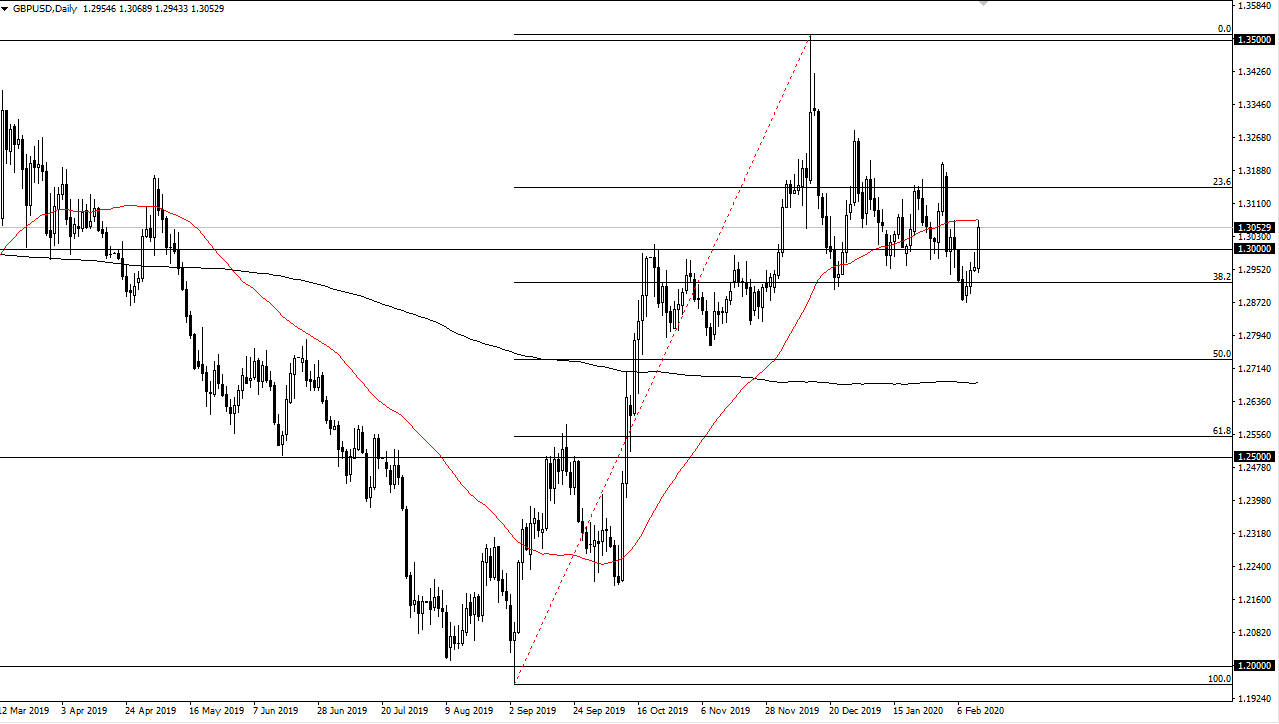

The British Pound rallied significantly during the trading session on Thursday as Boris Johnson is shuffling around in order to reflect a more stable move going forward. Breaking above the shooting star from the Wednesday session and of course the 1.30 level is a very strong sign for the Pound going forward. Ultimately though, it looks likely that we could pull back towards the 1.30 level, where I would anticipate more buyers coming in.

Having said that though, if the market were to break above the highs of the trading session for Thursday, then the market could go looking towards the 1.32 handle above which was the high that we fell apart from. Ultimately, keep in mind that the US dollar is very strong in general, so the fact that the British pound could rally against it is a very good sign that things are turning around for Britain. Furthermore, the British are working out a deal between themselves and the European Union, but those headlines will continue to bash things back and forth. I think given enough time the market will eventually go higher, so I do like the idea of buying short-term pullbacks as it offers value.

If we were to break down below the bottom of the candlestick from the week though, then it’s likely that the market could go to the 1.28 handle, possibly even down to the 200 day EMA which is colored in black on the chart and currently residing near the 1.27 handle. That’s an area that should be a massive floor the market, and if we were to break down below that level it would be a complete capitulation by the British pound and things could get rather ugly. I don’t anticipate that happening, and after the impulsive candlestick during the session on Thursday, it tells me that it is a bit of a “shot across the bow” when it comes to bullish pressure. Longer-term, I believe that this market goes looking towards the 1.35 handle above, which was the recent high after the Tories cleaned house in the most recent election. This doesn’t mean that the trade higher is going to be easy, so therefore you need to be patient and of course use as low of leverage as you can and build up a position over time as there are so many headline risks out there. Selling is isn’t a thought right now.