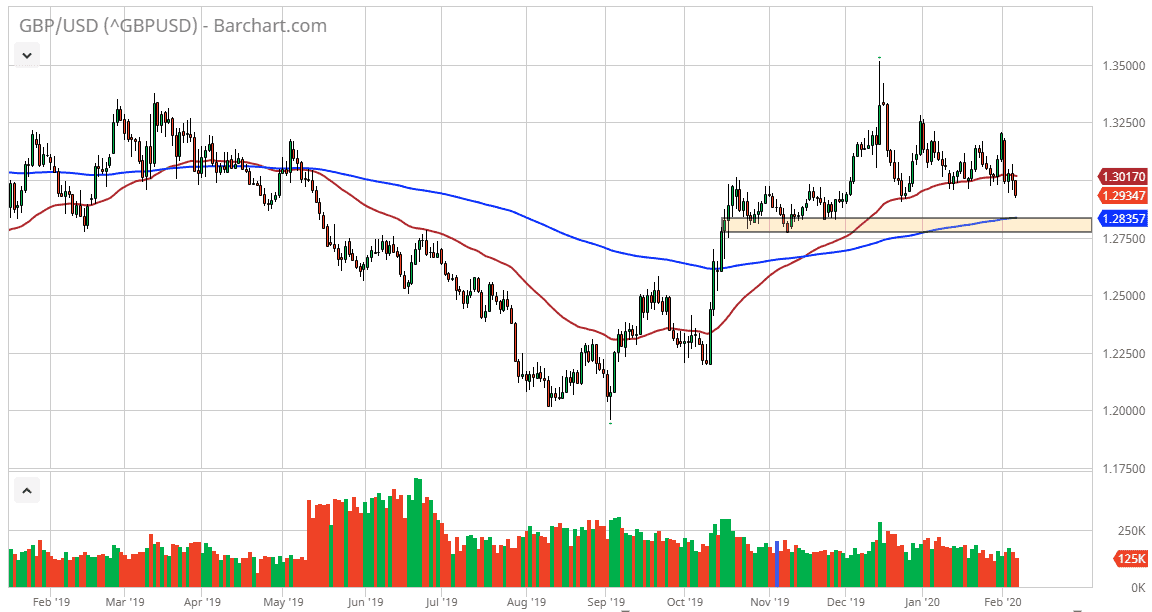

The British pound has broken down a bit during the trading session on Thursday, slicing through the 1.2950 level, an area that has been supportive of the last couple of weeks. The fact that we are broken through there suggests that there is further pain for the British pound, but at the end of the day this probably has very little to do with the British pound and more to do with the US dollar in general. After all, the US dollar has gained against almost every currency, so the British pound falling shouldn’t be much of a surprise.

Underneath, I see the 1.28 region as crucial, as it is not only structural support from the previous flag that formed, but there is also the 200 day EMA in that area as well, so I think that the downside is probably somewhat limited. The US dollar continues to strengthen against most currencies for good reason, as GDP in the United States continues to outpace the rest of the world but there is a bit of a relief rally after the beat down that the UK has suffered. The market looks as if it will probably find buyers underneath and with the jobs number coming during the trading session on Friday, it’s very likely to cause a significant amount of volatility. I do anticipate that somewhere around the 1.2750 level underneath will be massive support as well, so somewhere in that band that I have marked on this chart we should see buyers return. However, if we were to break down below the 1.2750 level, the market probably unwinds drastically. Look at this pullback as a buying opportunity as we are still in an uptrend, so I do think that it’s only a matter of time before we get the occasional pullback that helps. The most likely outcome is a dip lower based upon a stronger than anticipated jobs number, and then perhaps of value hunting. If we do get the bigger break down, then the 1.25 level will be the next support level given enough time.