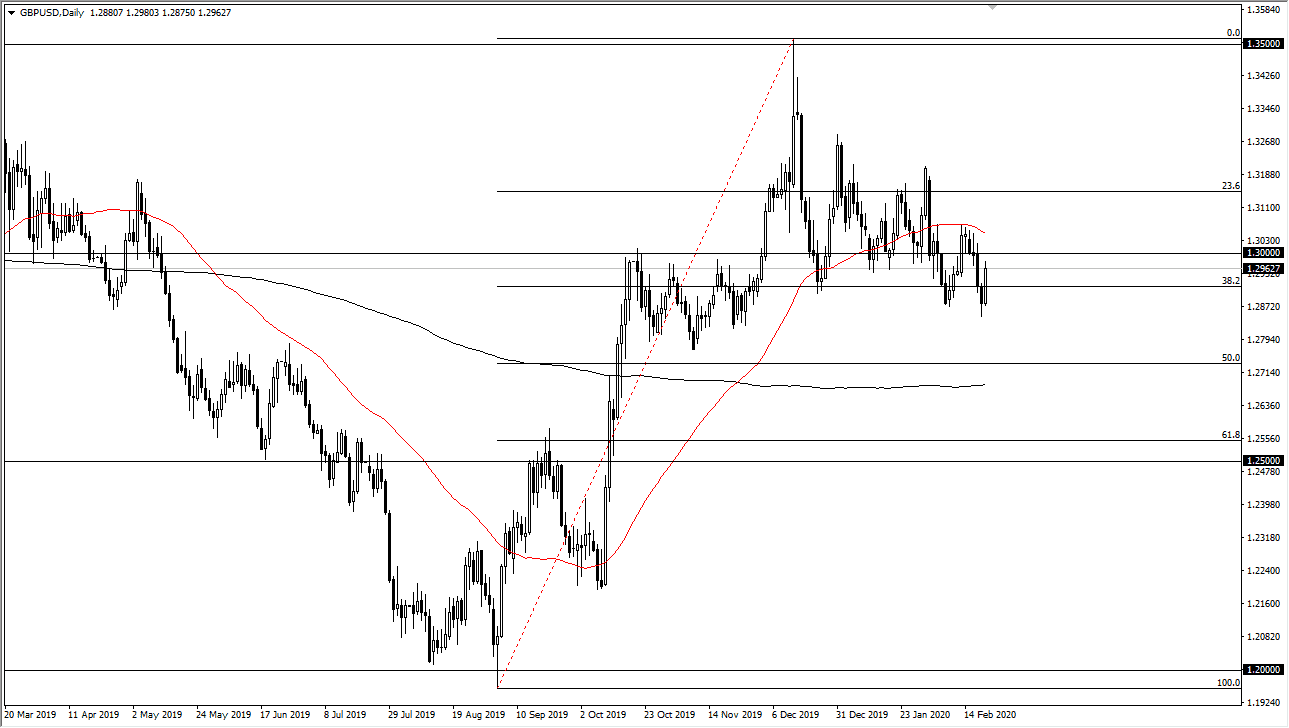

The British pound rallied a bit into the weekend, showing signs of resiliency. Having said that, the market is likely to continue to see a lot of back and forth but it should be noted that the British pound has shown some resiliency, but keep in mind that the pair features the US dollar, which of course is one of the strongest currencies in the world right now. That being said, the 1.30 level should offer a bit of resistance, as will the 50 day EMA. If we can break above the 50 day EMA, then the market is likely to go looking towards the 1.32 level. Above there, the market should then go looking towards the 1.35 handle after that, as it was the recent highs.

That being said, it is going to be difficult for the British pound to continue to climb against the greenback, and if you are looking to take advantage of resiliency in Sterling, you probably are going to be better off buying the British pound against other currencies. Ultimately, there is a lot of support underneath, especially near the 1.27 level, as the 200 day EMA is in that general vicinity. We have been drifting a little bit lower, but I do think that we are getting to a point where we will see the market try to build a certain amount of a base at this point.

This market should continue to see a lot of volatility, mainly due to the risk environment that we find ourselves and right now. Furthermore, beyond the Chinese situation and the coronavirus, it’s very likely that the negotiations between the British and the Europeans to continue to cause major issues as well. Ultimately, this is a market that will be moved back and forth due to the various headlines, and the uncertainty surrounding that situation. That being said, the British economy has done fairly well, so having said that the fact that the market hasn’t fallen apart during the Brexit situation shows that people are more than willing to bank on the fact that the British economy is stronger than anticipated, and then of course the history of this currency pair suggests that it is very undervalued longer-term as well. At this point, I look for value but I think that it’s going to be difficult to hang on to a move until we clear the 50 day EMA at the very least.