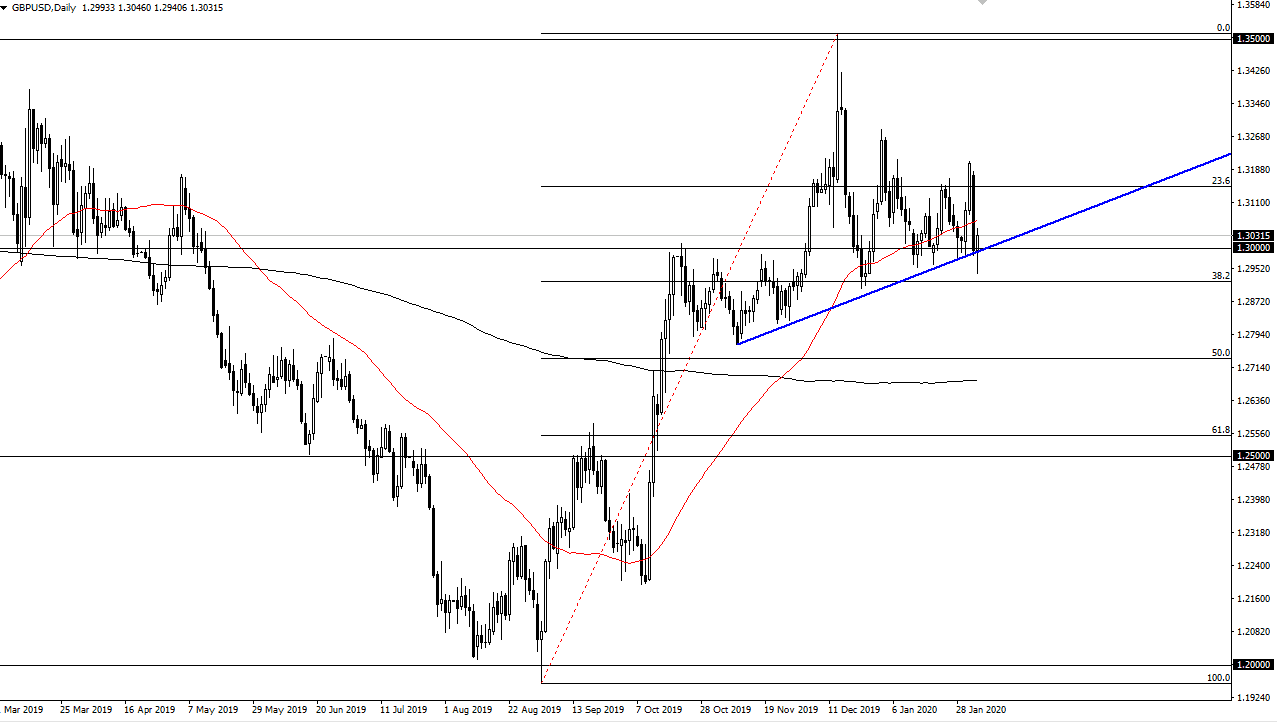

The British pound initially fell hard during the trading session on Tuesday, breaking down below a rather significant trendline before finding buyers again. Most of what has been causing problems with the British pound over the last 48 hours has stemmed from Boris Johnson scoffing at the idea of obeying EU regulations now that Brexit is done. If the European Union has a significant amount of regulations that are put upon companies and products, much more stringent than most of the rest of the world is willing to deal with. Boris Johnson stated that he would rather go to a “default situation” using the WTO agreement with the European Union rather than give up British sovereignty in the form of trade. If that’s the case, then we could see tariffs between the United Kingdom and the continent.

However, it’s as if the market suddenly remembered that there is 11 months of negotiation ahead, and we have seen this drama before. It’s a lot of posturing ahead of the negotiations where real work gets done. Ultimately, both of these economies not only want a trade deal but need a trade deal going forward. In other words, it’s a bigger customer. One would have to like the prospects of a free trade agreement between London and Washington. If it’s not free trade, it’s going to be something very close.

Because of this, and the fact that the European Union is a bit stagnant, it is my belief that eventually the Europeans will cave on a few things and work out some type of deal with the British. I also believe that the market thinks this as well as seen by a move higher in the British pound. Yes, there is going to be the occasional short-term algorithm driven panic based upon the idea of them not coming together and getting some type of an agreement, but there are 11 months to go before that becomes a real concern. With that, these dips tend to be buying opportunities as we have seen during the trading session. The 50 day EMA above could offer a little bit of resistance but I fully anticipate that this market is keen on getting back towards the 1.32 handle.