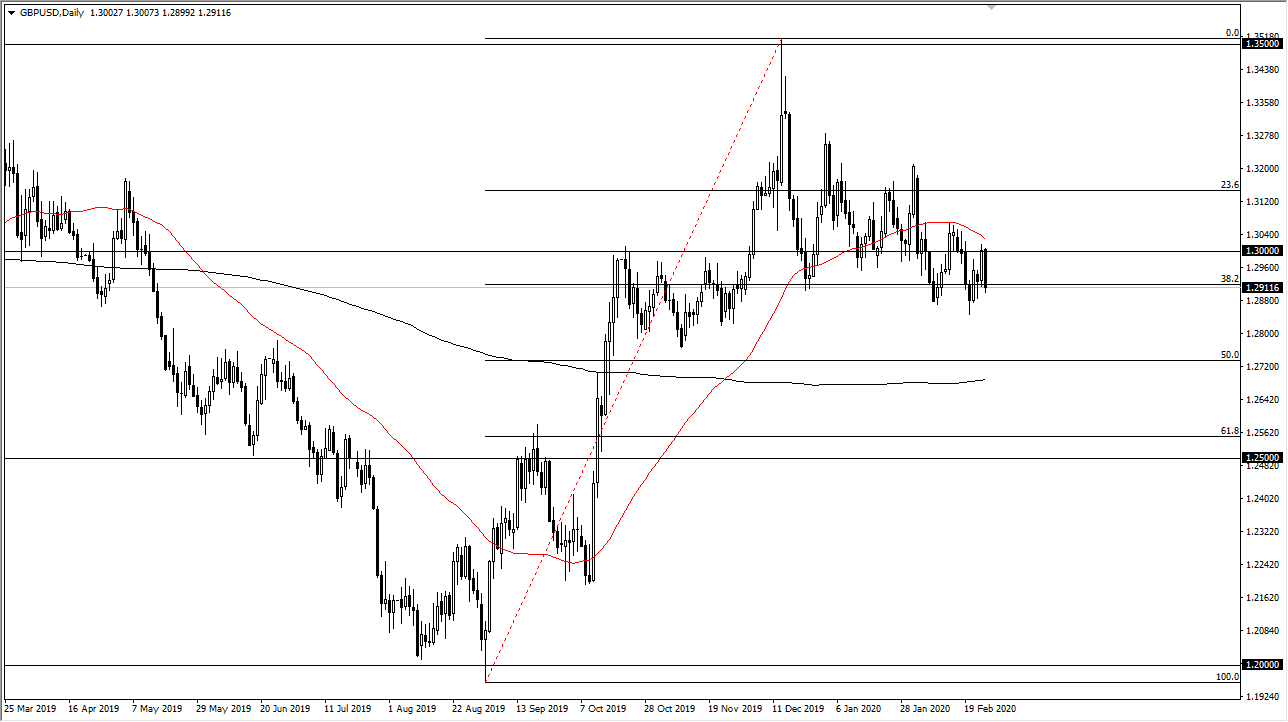

The British pound fell hard during the trading session on Wednesday, as we continue to look at support just below and it appears that we are trying to form some type of basing pattern. That being said, the market closed towards the bottom of the candlestick which of course is not a good look. The 1.2850 level for me is support, so if we were to break down below that level it’s likely that this market will go looking towards the 200 day EMA below at the 1.27 area. Having said that, the market has been consolidating for a couple of weeks so don’t be overly surprised if it turns around and rallies a bit.

The 50 day EMA has offered quite a bit of resistance as of late so it will be interesting to see if we get some type of break out above there. In the short term I would anticipate that there will be plenty of interest in that area, especially considering that the 1.30 level is sitting right there. Markets love big numbers, and that is about as big as it gets.

The British pound of course has to deal with external issues beyond just the coronavirus or the usual risk sentiment, things mainly in part to the negotiations between the United Kingdom and the European Union. Because of this, expect this market to be one that is somewhat choppy and could move suddenly based upon some errant comment by a politician as they use the press to threaten one another. At the end of the day though, the European Union is most certainly on the ropes and the British have much more leverage than they once did. This will be especially true as talks between the British and the Americans are going on simultaneously, and it’s difficult to imagine a scenario where the United Kingdom and the United States don’t have some type of workable trade agreement relatively soon.

The candlestick is very negative, and it does suggest there is going to be a bit more in the way of selling pressure, so it really comes down to whether or not it can hold through the Asian session and the London open. If the market turned back around, it’s very likely that the traders will try to go towards the top of the short-term range. Expect a lot of noise over the next couple of trading sessions.