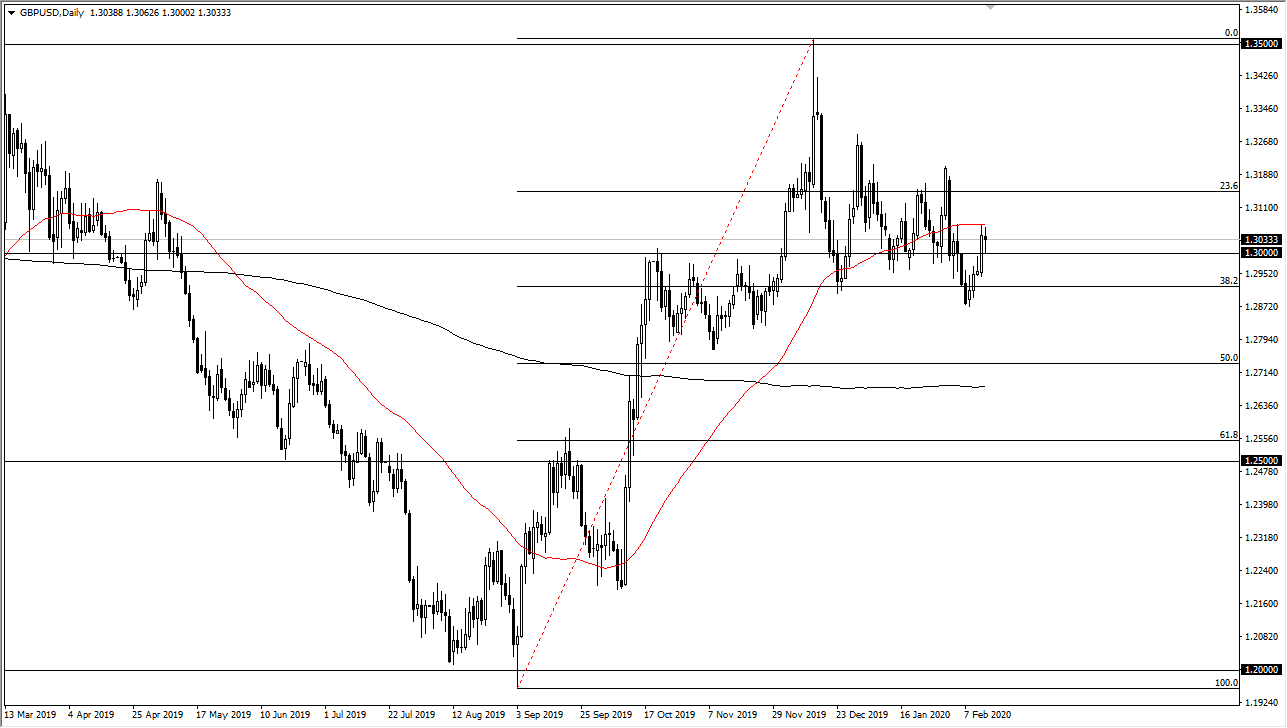

The British pound has pulled back a little bit during the trading session on Friday, to reach down towards the 1.30 level. That has been an area that catches the imagination, and we have bounced in order to offer a bit of value when slam into the 50 day EMA. The 50 day EMA is a relatively widely followed indicator, and as a result it’s not a huge surprise to see the Thursday and the Friday candlestick found out to be the high. However, if we can break above that level it’s likely that the market will go looking towards 1.32 level given enough time as it is the top of the short-term range. Between now and then though, I think that short-term pullbacks will continue to be bought into unless of course we get some type of headline that shocks the market.

The yes, the US dollar has been extraordinarily strong, but the British pound is operating in its own universe right now. The Brexit situation has made it a bit of a difficult asset to handle at times, but the United Kingdom now has a united government, so that is something that should not be overlooked. As they negotiate with the Europeans, they are on much better footing than they once were. In fact, it wasn’t until a few months ago that people were willing to say with 100% certainty that the UK was even going to be able to leave the European Union.

Looking at the setup, even if we did break down below the 1.30 level, I think there is a significant amount of support near the 1.2875 handle, so therefore it’s only a matter of time before value hunters will come back. Remember, even though the last couple of years have been horrific for the British pound, the 1.30 level actually is relatively cheap for this currency pair. Even if we break down from here, I believe that there is a massive amount of support near the 200 day EMA which is currently trading at the 1.27 level. Once we break that then I start to think about a downtrend again but all things being equal it looks as if the British pound is trying to turn around based upon value if no other reason. I currently have no plans to short this market although I do like the dollar in general.