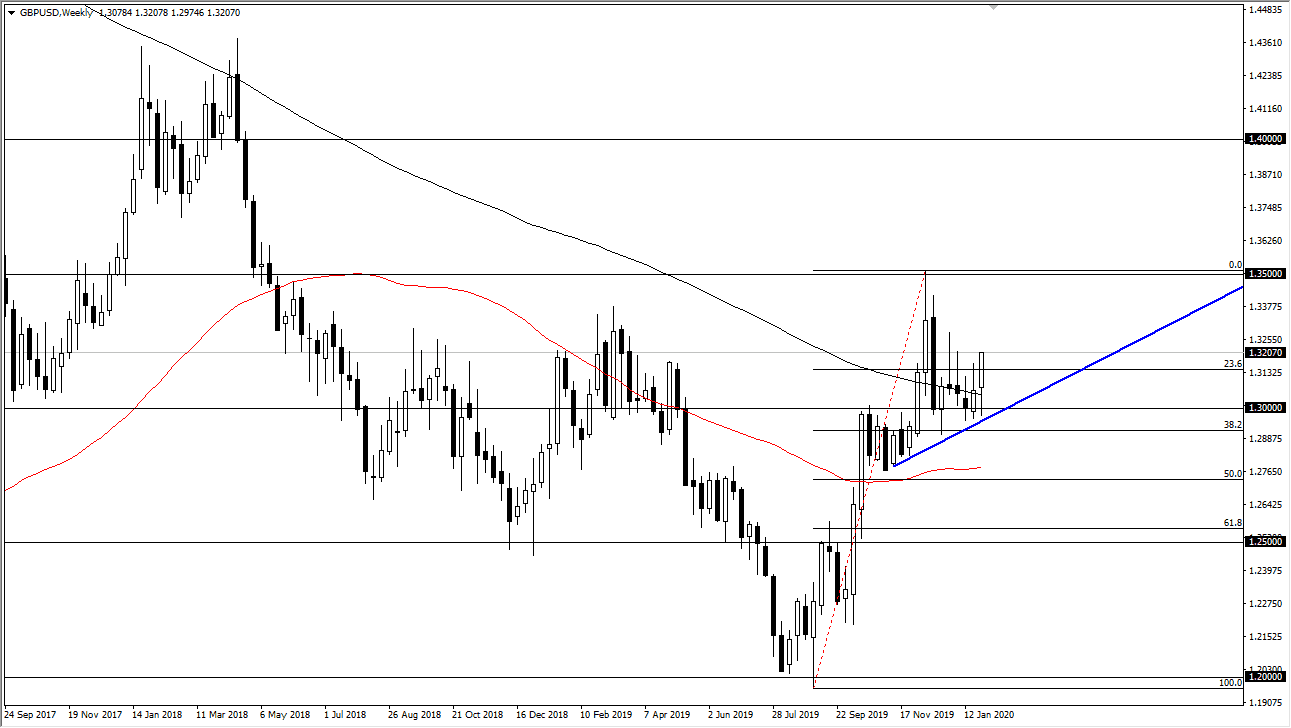

The British pound initially fell during the month, but as you can see it has been rather resilient. This was especially true during the last week of January, as the Bank of England chose not to cut interest rates. This of course is good for a currency when the interest rate stay stable, and during the same week we also have the Federal Reserve suggest that perhaps they may have to cut interest rates down the road or at least were open to it. That being the case, the market favors the British pound and close that the very top of the range for the week. That of course is a very bullish sign, and now it looks like the market is ready to go back towards the highs again. Ultimately, short-term pullback should continue to be buying opportunities, as the uptrend line has held quite nicely. In fact, if you look at the daily chart you can almost make an argument for a symmetrical triangle breaking out.

The 1.35 level above has been massive resistance, and at this point it’s difficult to see this pair going through there easily, but it certainly looks as if it is going to try to get there. Expect a lot of back and forth choppiness but given enough time I do believe that the British pound continues to recover from an extremely oversold condition after the Brexit vote. We are now looking at a scenario where the worst case scenario has been priced out of the market, or at least is in the process of being done. The uptrend line being broken to the downside would of course be very negative but obviously it would take some type of event for that to happen. At this point, I think it’s obviously a market that you can pick up little bits and pieces on pullbacks, but that doesn’t mean that is going to be easy. I favor the uptrend for several months going forward, especially as Brexit is sorted out between the British and the Europeans. As we get more details on how the entire situation between London and Brussels plays out, more comfort should come with the idea of owning Sterling. That being said, there is also the risk of some type of shock coming out of the negotiations but we have probably seen the worst previous months, and therefore it continues to show the likelihood of the upside.