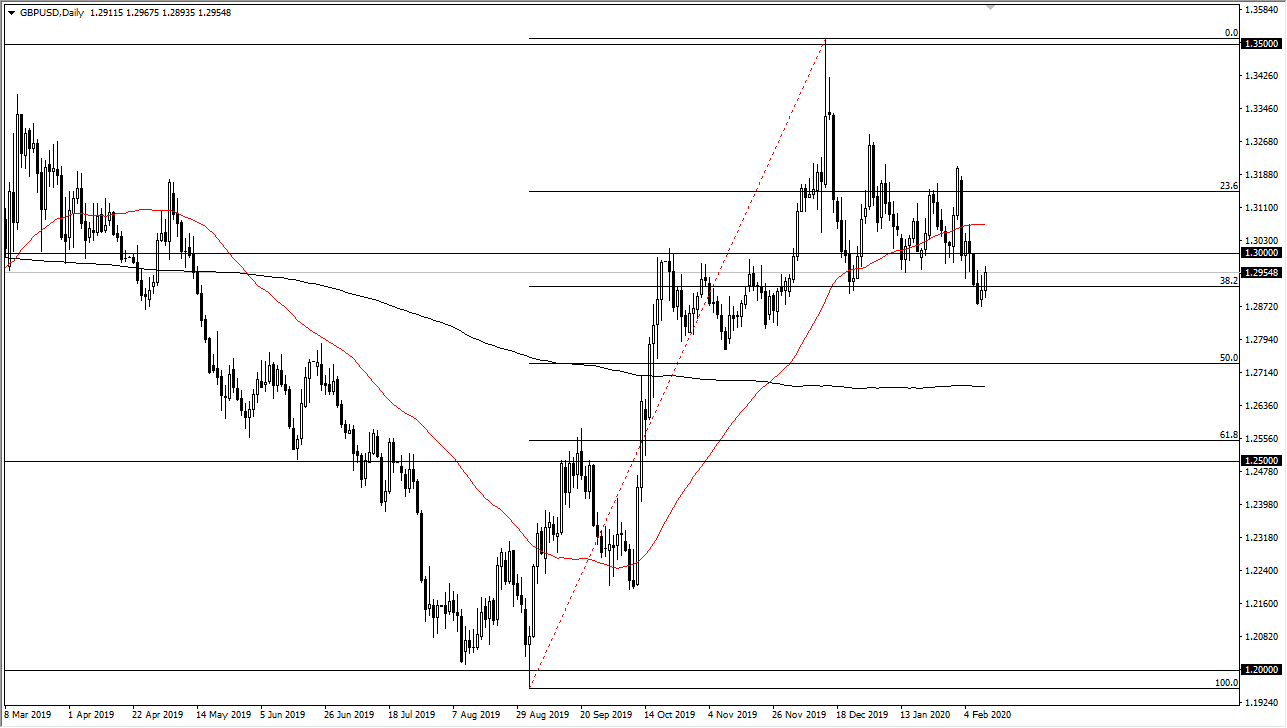

The British pound has rallied during the trading session again on Monday, but unlike the previous couple of sessions, the market has retained most of its gains, which shows a tenacity of that looks as if the buyers are willing to continue to fight. If the market can break above the 1.30 level, then I believe that the psychological aspect of trading will shift in favor of the British pound, at least in the short term. A break above that level could send this market looking towards the 50 day EMA.

Looking at the chart, I believe that the next target after that would be the 1.32 handle, as it has been massive resistance, but ultimately the market has broken above there in the past and it should be noted that the British pound is historically cheap at these levels. The US dollar has shown quite a bit of strength, but as the timeline continues through the negotiations between the European Union and the United Kingdom, it should become more apparent that the British are in a much stronger situation than they had been previously.

With that being said, the market is likely to continue to favor buying dips on longer-term charts, which is essentially what we have just seen. I believe at this point the market also has support underneath near the 1.28 level, and then of course the 200 day EMA after that. The most recent Bank of England rate decision was to hold still, something that shows that the Bank of England is fully aware of the better than anticipated economic figures coming out of London, and that of course suggests that perhaps the United Kingdom is doing much better than anticipated. All things being equal, I do believe that the longer-term uptrend should continue, although it is going to be a very noisy process to say the least. If we did break down below the 200 day EMA, then I would have to start looking at shorting, at least until we get down to the 1.25 handle. However, I’m the first to admit that this is a market that looks like it still trying to find its way higher over the longer term.