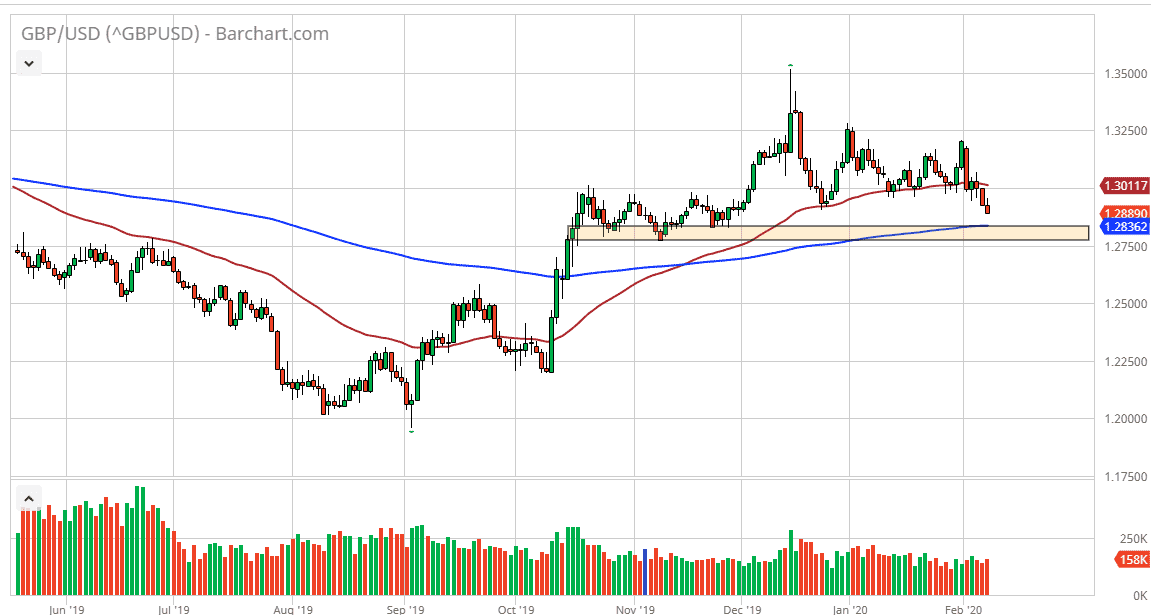

The British pound broke down again during the trading session on Friday as we continue to see a lot of weakness coming out of everything that is not American. The British pound looks as if it is going to go looking towards the 200 day EMA, currently at the 1.2836 level. The 1.28 level itself should be rather supportive anyway, as the British pound has bounced from there are a couple of times recently. However, if we are to break down below the 1.2750 level, it’s very likely that the British pound will then go looking towards 1.25 level. While I am not overly negative on Great Britain right now, the reality is that the United States is by far the strongest economy out of the major grouping.

The 50 day EMA above could offer resistance, but if we were to turn around a breakout above the 1.30 level would be a very strong sign. Longer-term, I do believe that the British pound will go looking towards 1.35 level again, but we obviously need to build up the necessary momentum and get beyond a lot of the nonsense when it comes to the Brexit negotiations with the European Union. While the British are technically out of the European Union now, there is still the discussions involving a trade pact between the two economies.

Previously, the European Union certainly had the upper hand as Great Britain couldn’t come to terms with whether or not it wanted to do specific things. However, we have sent out an election that brings on a much more unified British government, something that the European Union does not have. At this point it’s only a matter of time before the buyers come back but for me it certainly looks as if we have more downward pressure in the short term coming when it comes to the British pound. That being said, if we get the right bounce or support of candlestick near the 200 day EMA, I am more than willing to play the bounce. To the downside, I believe that there are plenty of value hunters waiting to get involved but if the British pound does bounce against the US dollar, it will probably have more luck against other currencies such as the Australian dollar, Canadian dollar, or perhaps even the New Zealand dollar. The US dollar is simply too strong to think that a bounce in this pair is going to be strong in the short term.